Tuesday, December 30, 2025

When I setup my new e-commerce site WiredShops in September 2021, I also had to register a Sales and Use Tax number with the State of Maryland.

I wanted the experience of installing and operating an online shop and chose drop shipping as the method to source inventory.

Although, I was able to source inventory, integrate a PayPal shopping cart, and gain valuable experience with OpenCart, I never had any sales except those I used to test the platform.

That said, every quarter I filed with the State of Maryland comptroller's office what is known as a Zero Use Tax Return using an automated phone system.

In February 2024, Maryland offered a new service for businesses to report

tax filings and the Zero Use Tax Return filings were also

moved to the new online service, Maryland Tax Connect.

Initially, I was happy about the state's new online business tax filing

resource, however, after the first filing, I seemed to have problems. I was

also a bit confused about the preset start and end dates for each filing

period.

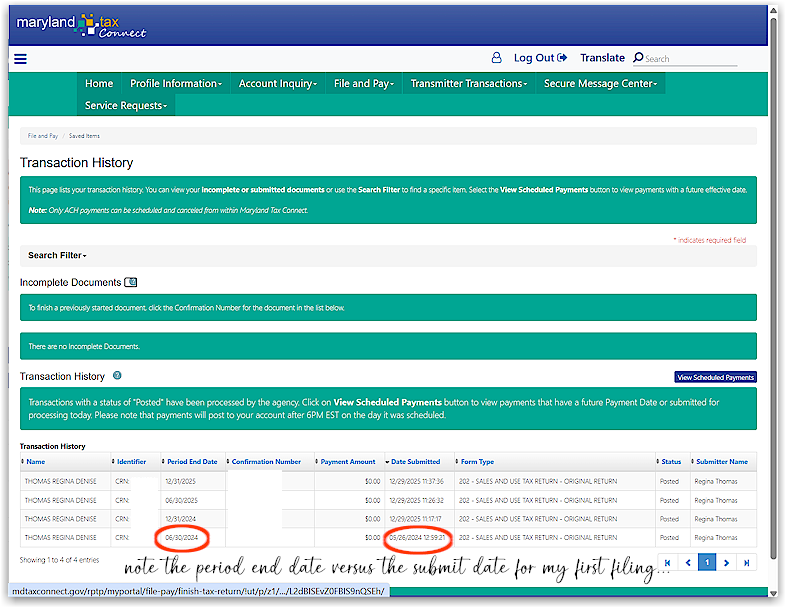

In the above graphic I provide a screen-grab of all of my filings since 2024 when the state's new system became available. The problem? I wanted to file the quarter filing which ended March 2024 and the only option I had was to file through to the end of June 2024 and it was only May 26, 2024 when I filed the return.

When I went online to file for the next quarter, forgetting I filed through to June 30, 2024 with the first filing, I was only offered the next period- July 1, 2024 through December 31, 2024 as the filing period. I could not understand why I was filing a return for a period that had barely begun.

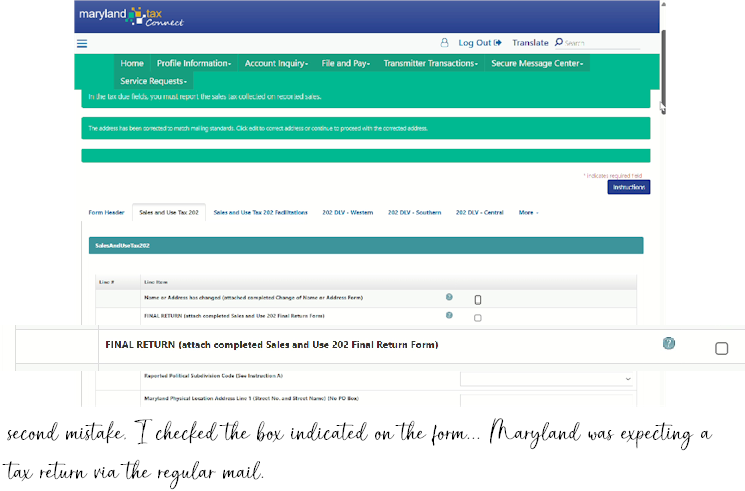

That is when I made the second mistake. As indicated by the graphic below,

I checked the box the read "FINAL RETURN (attach completed Sales and Use

202 Final Return Form)".

Even though I did not check the box with the May 26, 2024 filing (I know this because the filing was submitted and posted correctly), I misunderstood the instruction the second time around and checked the box in July 2024 or so.

I checked online for six months or so and the tax filing never posted so I thought it was a problem with the new system. And why was I filing for a time period that had not ended in the first place?

Turns out it was my error. Maryland was expecting a return in the mail and I was expecting them to post the filing I submitted online.

I am not sure when the July 2024 filing stopped showing up as a submitted filing. When I logged in today to figure out what to do about all of the Zero Use Tax Returns I needed to file, I noted it no longer showed up as a submitted filing.

Throughout all of this, Maryland Tax Connect reported that I owed no money insofar as taxes so I was not worried about having a penalty for not paying taxes. It just bothered me.

When I logged in today, I wanted to get all of this corrected and move on. I made the same mistake and noticed a problem (unfortunately, I cannot now remember what flagged, because the filing with the box checked, showed it was also submitted). I resubmitted the filing without the box checked and voila the return was submitted and posted.

Because I had to file three returns today, I screen recorded the final

return for the period July 1, 2025 through December 31, 2025. I redacted some

of the video information.

This bothered me? I should have checked earlier and I think I am lucky Maryland did not penalize me for the late filings. That said, I had been filing Zero Use Tax Returns since 2022- through June 2024, maybe that is what flagged on their side.

So happy this issue has been resolved. I will be moving on to several other end of the year issues e.g., the Amazon Product Advertising API (PA API) is being replaced and the USPS API is migrating to a new version.

Yes, I put down my Real Estate Course study guides for a minute, however, I will be getting back to them shortly.

Saturday, December 27, 2025

It snowed Sunday, December 14, 2025 and temperatures stayed below freezing for several days in the aftermath. This caused issues with one of the cars, however, I managed to get everything done.

I ventured out Wednesday, December 17, 2025, however, only used a photo (see Youtube video) of

the outfit I wore from

the video I captured- while trying to get out of the house early Wednesday

morning. Too worried about the car not starting. Worried in

vain.

With the exception of the initial car problems, everything went off as planned. After Wednesday, December 17, 2025, I did not have to go out again, however, did have several projects I needed to either start or finish.

The holiday meal was the same as the Thanksgiving meal, however,

substituted chicken for the turkey breast. In addition, we had butter

cake with chocolate icing and fresh strawberries & cream for dessert.

The short video below, provides the comfortable outfit I wore Christmas Day to finish cooking and host visiting family.

Some of the gifts....

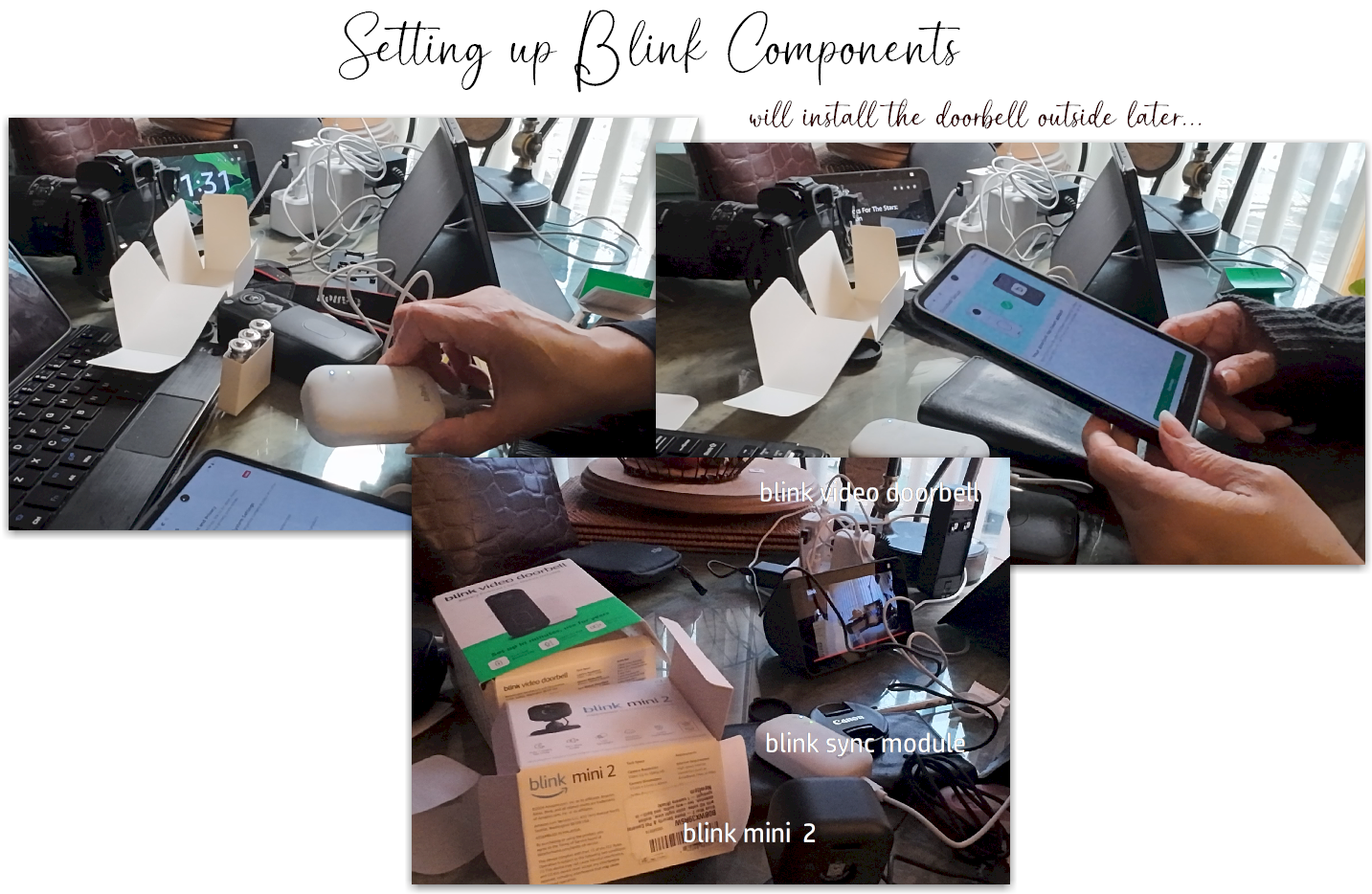

I videoed the un-boxing of the Blink components, however, decided to only use

the photos shown below.

Everything works great, however, I will install the video doorbell later. Below a list of some of the items I am very pleased were under the tree this year.

- McCook Knife Set

- Blink Video Doorbell & Sync Module

- Blink Mini 2 Camera

- Day Planner

- Royal Dansk Danish Butter Cookies

- Stackable Stoneware 11oz Coffee Cups (not available through Amazon)

Hoping your holidays are going as planned. I plan to complete the other four real estate courses I need to renew my Maryland license in April 2026.

For some reason, though I paid for the courses

in November 2025, I put off

starting the sessions. Happy, on December 23, 2025 when I finally got the

first course out of the way. Also happy the certificate has already

been submitted to the Maryland Real Estate Commission.

Other plans for the New Year? I always have plans. Hope you realize yours as well.

Sunday, December 07, 2025

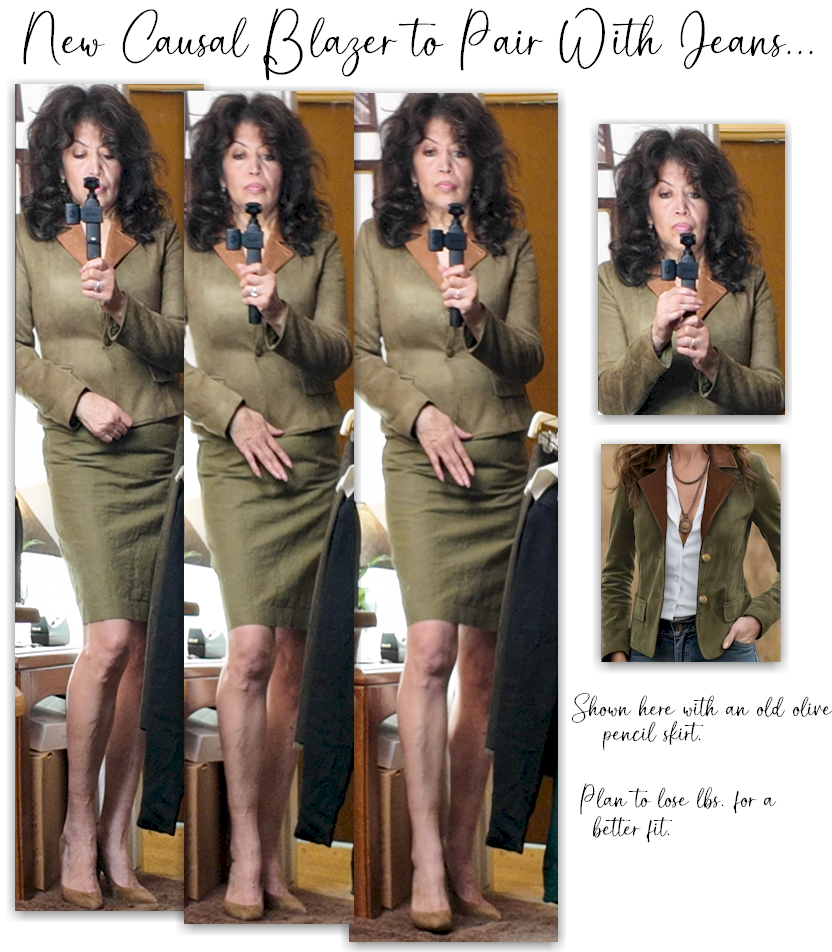

While holiday shopping I found two items I decided to add to my closet.

The first, an olive blazer with a brown lapel, I hope to pair with jeans. For some reason I have a hard time wearing jeans and continue to look for ways to style them.

I owned the same blazer in black w/brown lapel, so I knew the lined

jacket was something I would like, however, a bit surprised the olive jacket

is a bit tighter than the black. I continue to have success with my diet, so I

am not that concerned the blazer is a little tight.

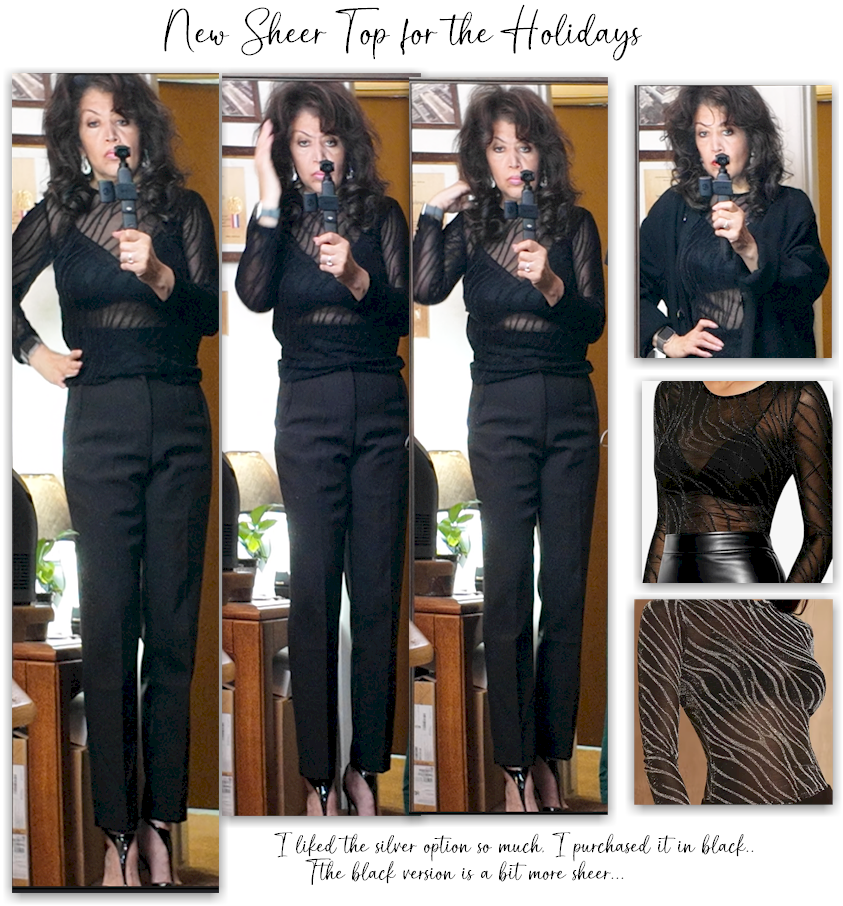

The other item, also something I owned in another color

(see photo on the right), another top I can wear

for holiday events.

The other item, also something I owned in another color

(see photo on the right), another top I can wear

for holiday events.

Below, a short video of the holiday style I tried on Friday, December 5,

2025 after the new top arrived with other holiday packages.

Except for a few holiday extras, I am done with the holiday shopping and happy I can sit down and relax till the end of the year.

Thursday, December 04, 2025

It has been cold in my area since Thanksgiving. Yesterday, after waiting on a morning package delivery, I took care of several errands. I chose to wear my long black pleated wool skirt, chocolate cashmere sweater with a black velvet collar, my brown suede blazer, and chocolate Nine West boots.

By the time I finished yesterday evening, it was after 5 and pretty dark. I should have worn gloves.

The last time I wore the long black pleated wool skirt I purchased in the late

80s, was November 2008 for a Meetup in Washington, D.C. Below photos of

the ensemble I wore for the evening Meetup at the large eatery across from the

Verizon Center (now Capital One Arena).

Why no video? By the time I finished editing there would have been very little footage. Not happy with how I captured the video and I thought the outfit looked better in person.

Sunday, November 30, 2025

It has been a busy two weeks. In early November, I decided to capture most of my activities, in hopes of creating content for a video. I did, however, decided to only use the content mainly from the Thanksgiving meal preparations.

Below, the video I finished editing this morning, Sunday, November 30,

2025.

This is one of my longer videos and one that helped me to decide I really do not have the time to create this type of content on a regular basis. If you have stopped by my Youtube Channel, you will note, I like short videos showing an outfit I chose to wear or try on.

Do you ever wonder if Youtube content creators have editors or are they doing the work themselves? I created several voice overs for this video, and though had no problem with the scripts, had to re-record the voice overs several times before use.

That said, I like doing this type of work, I simply do not have the time. I also like the power Davinci Resolve offers for this type of production effort.

Hope you had a great Thanksgiving and yes, I thought I did a pretty good job with the Thanksgiving meal. How about the roast beef? I love roast beef sliders on Hawaiian rolls with Heinz 57 sauce.

Wednesday, November 26, 2025

It seems for the last week, all I have been doing is handling minor business issues, cooking, and trying to find the deals I want for holiday gifts.

I think today, I finished most of the hard work for the Thanksgiving meal. In addition, I also completed most of my holiday gift buying.

This year, again- I went with more practical gifts rather than extravagant.

A gift I wanted this year? The new book by John Grisham, "The Widow ". I have not had the chance to read a good book in awhile.

That said, every Wednesday, The New York Times updates its Hardcover Fiction Best Sellers list and I, in turn update the WiredPages Libraries page to reflect their new listings. (See this post to see how I accomplish this.)

Below the HTML I inserted this evening to the WiredPages Libraries page in the form of the images and

Amazon links to the new list of New York Times® Best Sellers.

For the week of: 11/26/2025

|

|

|

|

|

|

|

|

|

As an Amazon Associate I earn from qualifying purchases.

Hope your holiday plans are taking shape. I was not worried about the plans I made. Everything is mostly going to plan. My concerns are the many issues out of left field I did not plan on. That said, I am getting through each issue one at a time. Happy I can say this.