Tuesday, December 30, 2025

When I setup my new e-commerce site WiredShops in September 2021, I also had to register a Sales and Use Tax number with the State of Maryland.

I wanted the experience of installing and operating an online shop and chose drop shipping as the method to source inventory.

Although, I was able to source inventory, integrate a PayPal shopping cart, and gain valuable experience with OpenCart, I never had any sales except those I used to test the platform.

That said, every quarter I filed with the State of Maryland comptroller's office what is known as a Zero Use Tax Return using an automated phone system.

In February 2024, Maryland offered a new service for businesses to report

tax filings and the Zero Use Tax Return filings were also

moved to the new online service, Maryland Tax Connect.

Initially, I was happy about the state's new online business tax filing

resource, however, after the first filing, I seemed to have problems. I was

also a bit confused about the preset start and end dates for each filing

period.

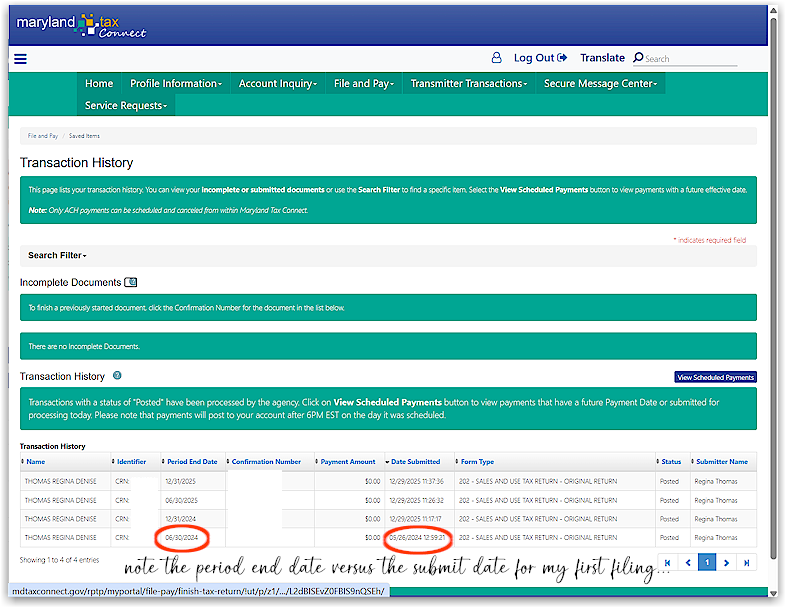

In the above graphic I provide a screen-grab of all of my filings since 2024 when the state's new system became available. The problem? I wanted to file the quarter filing which ended March 2024 and the only option I had was to file through to the end of June 2024 and it was only May 26, 2024 when I filed the return.

When I went online to file for the next quarter, forgetting I filed through to June 30, 2024 with the first filing, I was only offered the next period- July 1, 2024 through December 31, 2024 as the filing period. I could not understand why I was filing a return for a period that had barely begun.

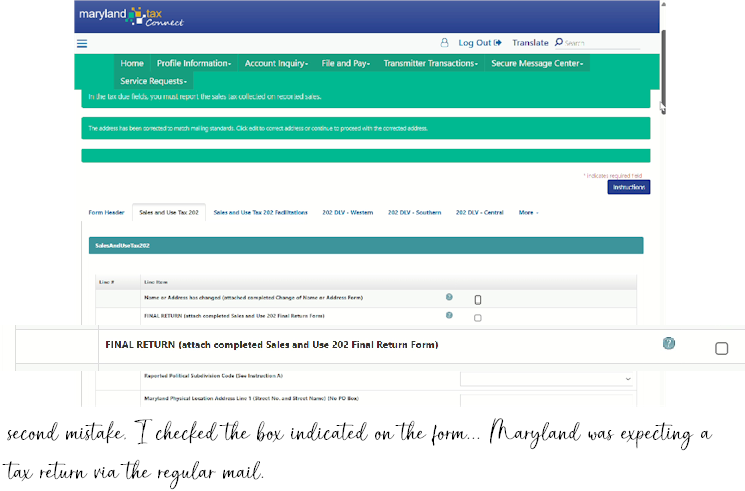

That is when I made the second mistake. As indicated by the graphic below,

I checked the box that read "FINAL RETURN (attach completed Sales and Use

202 Final Return Form)".

Even though I did not check the box with the May 26, 2024 filing (I know this because the filing was submitted and posted correctly), I misunderstood the instruction the second time around and checked the box in July 2024 or so.

I checked online for six months or so and the tax filing never posted so I thought it was a problem with the new system. And why was I filing for a time period that had not ended in the first place?

Turns out it was my error. Maryland was expecting a return in the mail and I was expecting them to post the filing I submitted online.

I am not sure when the July 2024 filing stopped showing up as a submitted filing. When I logged in today to figure out what to do about all of the Zero Use Tax Returns I needed to file, I noted it no longer showed up as a submitted filing.

Throughout all of this, Maryland Tax Connect reported that I owed no money insofar as taxes so I was not worried about having a penalty for not paying taxes. It just bothered me.

When I logged in today, I wanted to get all of this corrected and move on. I made the same mistake and noticed a problem (unfortunately, I cannot now remember what flagged, because the filing with the box checked, showed it was also submitted). I resubmitted the filing without the box checked and voila the return was submitted and posted.

Because I had to file three returns today, I screen recorded the final

return for the period July 1, 2025 through December 31, 2025. I redacted some

of the video information.

This bothered me? I should have checked earlier and I think I am lucky Maryland did not penalize me for the late filings. That said, I had been filing Zero Use Tax Returns since 2022- through June 2024, maybe that is what flagged on their side.

So happy this issue has been resolved. I will be moving on to several other end of the year issues e.g., the Amazon Product Advertising API (PA API) is being replaced and the USPS API is migrating to a new version.

Yes, I put down my Real Estate Course study guides for a minute, however, I will be getting back to them shortly.