Saturday, September 27, 2025

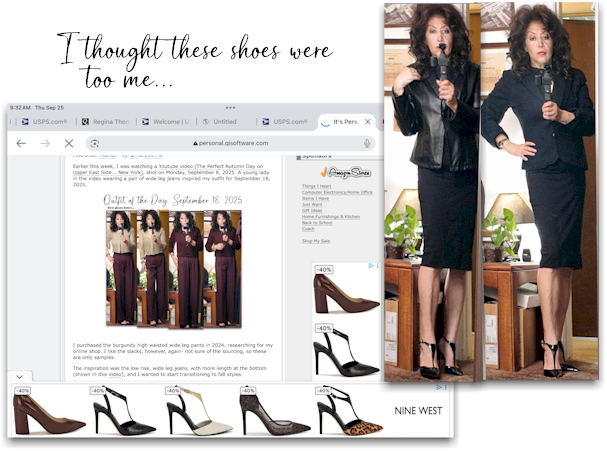

In July or August, I noticed the Nine West Fiesta Pointy Toe Pump (Black/Croc) that I immediately placed in my cart. I tend to do things like that, however, wait until I can talk myself into purchasing.

In this case, the shoes were over $100 and I could not justify the

purchase even though I immediately decided I wanted those heels.

In this case, the shoes were over $100 and I could not justify the

purchase even though I immediately decided I wanted those heels.

Then on

September 23rd, the shoes went below $50 because of rewards points, my Amazon

Visa Rewards Card (scan the QR code on the right or use this link to apply for the

card)- which Nine West (AmazonPay) accepts as a payment method, and an after

Labor Day sale.

Needless to say, I purchased them.

Below a short video of the un-boxing and try ons of the shoes with less

formal wear.

That said, I am planning to pair the shoes more often with formal attire. The try on outfit piece descriptions are provided in the video summary.

Sunday, July 13, 2025

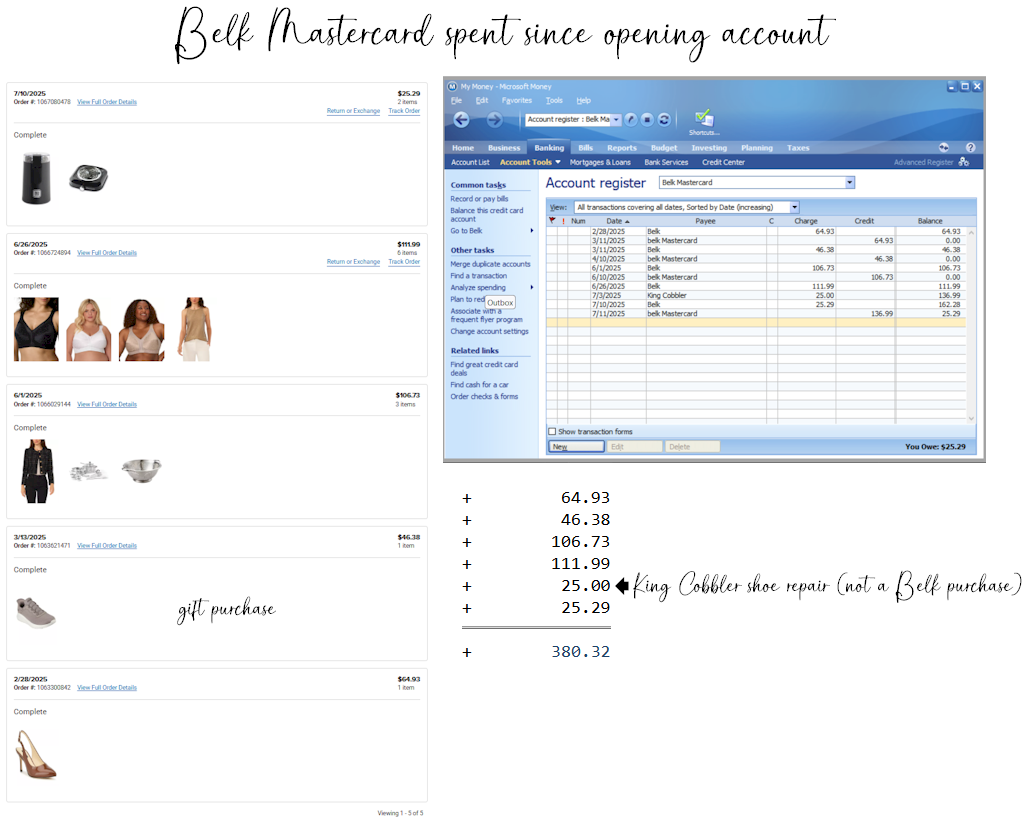

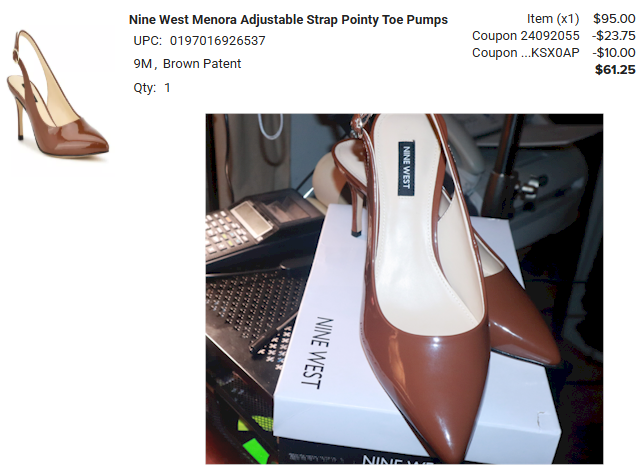

In February, I opened a Belk Rewards+ Mastercard account because they were offering the best price on a pair of Nine West pumps I wanted with additional incentives if approved for the Rewards+ Mastercard. See later references for the cost of the Nine West pumps.

The illustration below shows all of the purchases I have made with the card

since late February 2025.

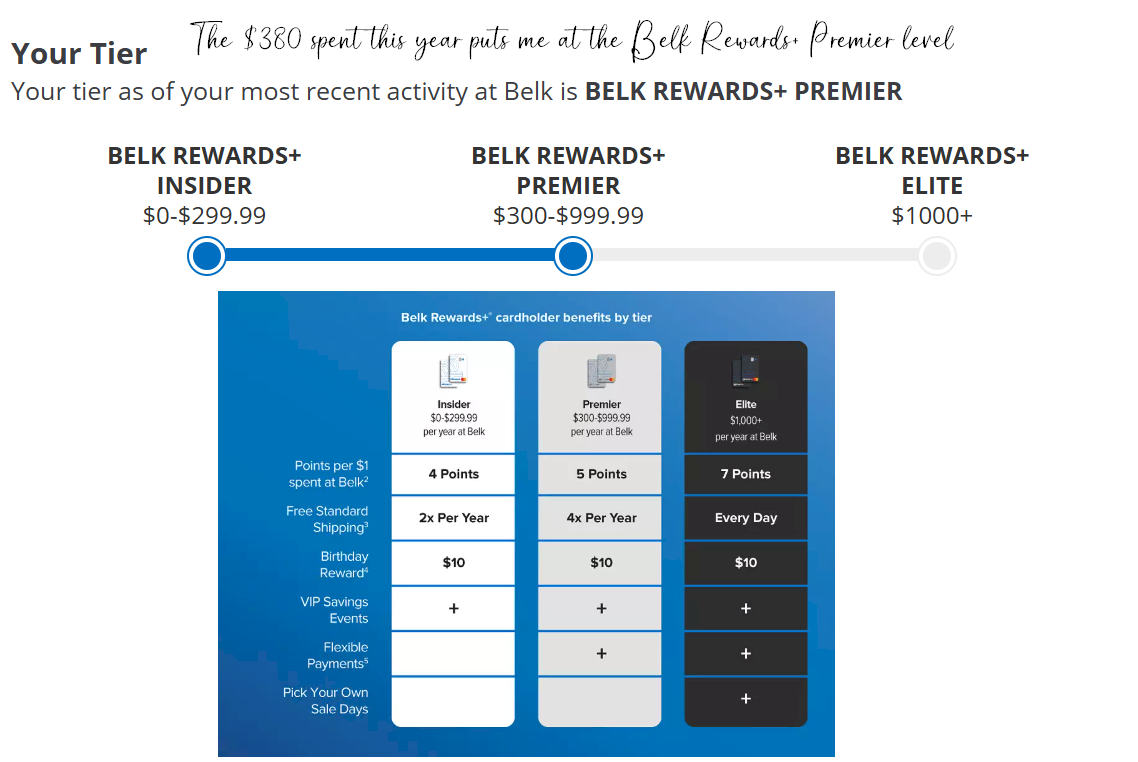

When I first opened the account, my tier level was at the Insider level. Recently, I received a new card because my tier level was updated based on

my spending since February 2025. On the right, illustration of the old and new

cards.

When I first opened the account, my tier level was at the Insider level. Recently, I received a new card because my tier level was updated based on

my spending since February 2025. On the right, illustration of the old and new

cards.

Since getting the card, I have received any number of incentives to use the card including great prices on items I have wanted for awhile and about $35 in rewards (my birthday is in July).

How did I spend $380 using the Belk Rewards+ Mastercard? In early July, an email explaining- that if I spent $75 outside of Belk, I would get $20 in rewards. I used the card at the cobbler last week ($25), however, I do not think I am going to hit the $75 threshold by the end of the month.

The other expenditures using the card, all Belk online purchases are shown

below in the order they were purchased from earliest to latest.

Nine West Menora Caramel slingback pumps, purchased for spring and

summer.

BOBS from Skechers a gift for a relative.

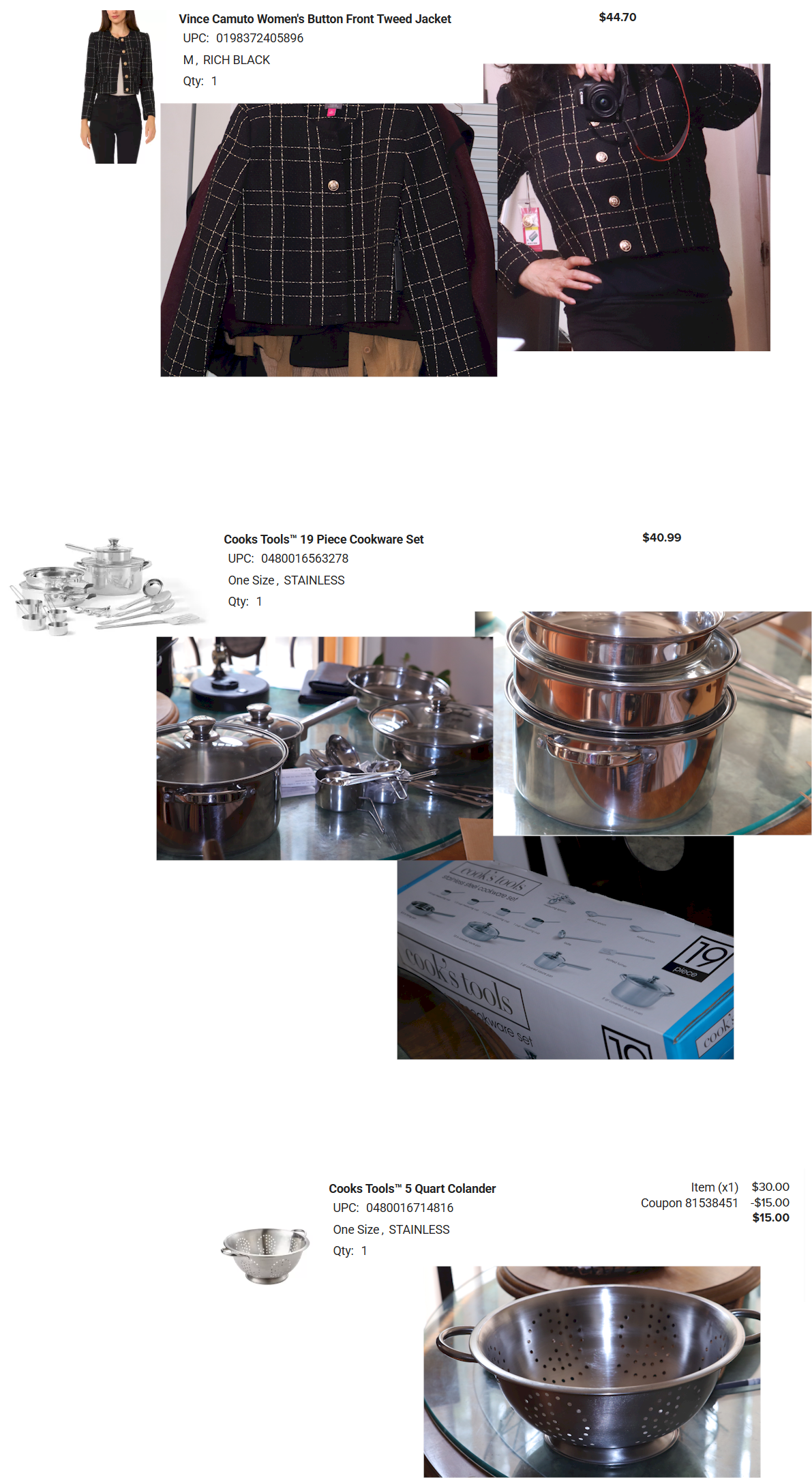

The next order consisted of 3 items. A note about the cookware. Although, I

have some rather expensive cookware for use with a glass top stove, I wanted

something a little less "used" for content creation. The $40.99

price for the 19 pieces I paid for a clearance package- was perfect. Also, I

cannot tell you how much I love my Vince Camuto jacket. When I first tried it

on, all I could say- "Hi, me." It is lined, tailored, and perfect. Yes, I used to purchase things like

the jacket as part of a suit, all the time.

The next order also consisted of multiple items including personal garments on

sale and a gold shimmer Vince Camuto knit top.

The last order, arrived yesterday and consisted of two kitchen items I

needed or wanted. The coffee mill was needed because the one

I use now works with a rubber band. The counter top single burner, I wanted also

for content creation and to be able to use a cast iron pan. I also had reward

dollars to use by the end of the month, hence the reason the order came to

$25.29 for both items including taxes.

Yes, I love my Belk Rewards+ Mastercard.

Sunday, May 25, 2025

For various reasons over the month of May 2025, I collected $150 in Amazon Gift Cards. This post and the related video discuss what I purchased with my gift cards. The image below shows the actual cost breakdown of my original Amazon order.

The illustration above, provides summaries for grooming supplies, I ordered, while discussing in more detail other aspects of a recent Amazon order which combined- depleted my Amazon Gift Cards balances.

The grooming supplies in question, were for hair care maintenance items I use on a regular basis. I also do not discuss these items in the video.

I am pretty pleased with the items I ordered with my gift cards, however, I am still carrying about $200 as a credit on my Amazon Visa. I discuss in an early post why I had a $521 credit on my Amazon Visa.

The following is a video about my recent order using my Amazon Gift

Cards.

Amazon Links for items discussed in the video.

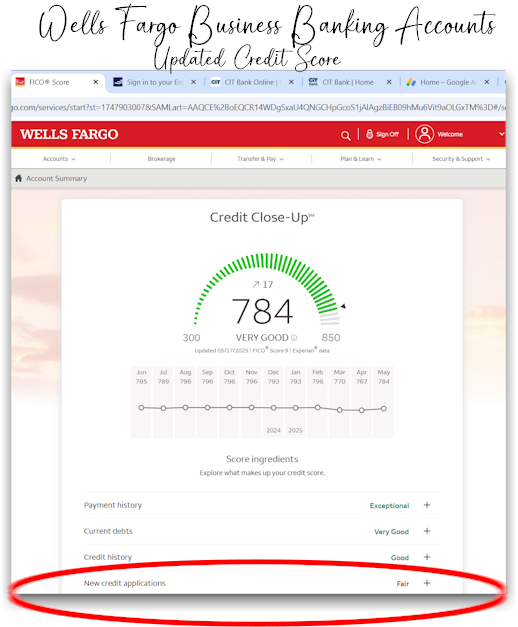

In other news related to my personal finances, my FICO score is finally on an

upswing after applying for two new credit cards earlier this year.

I applied for both cards because I liked the rewards being offered and since I would be spending the money in any case, felt I could justify adding them to my wallet. The downside with credit card applications? In the short term, even if you are good about paying off your cards, the application process takes a toll on your FICO score.

In other financial news, I do not know about you, but I do not always get a

Google Adsense paycheck. This month I did.

It is Memorial Day weekend and I have spent a lot of time experimenting with Davinci Resolve. Think I am going to use the grill tomorrow. Hope you are having a nice holiday.

Friday, May 02, 2025

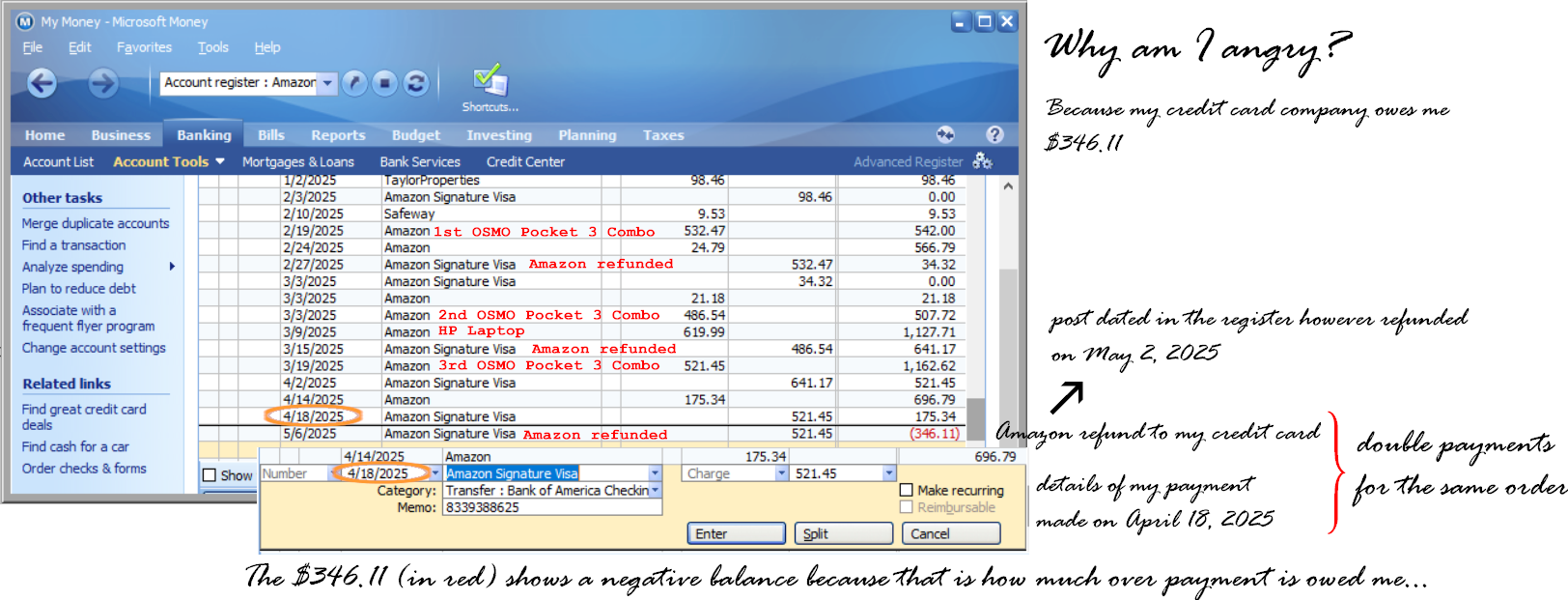

I am rather angry about all of this. Lets first start with my 3 Amazon orders for the DJI Osmo Pocket 3 Creator Combo bundle.

Those of you who have researched this product insofar as pricing, know that even in late February when I placed my first order, I found several great deals.

Also keep in mind, on April 18, 2025 the price for any of the bundles shown, was double what I originally paid.

At the time of my first order, I had in my Costco online cart the DJI Osmo Pocket 3 Capture More Combo which does not come with the DJI Mic 2 Transmitter, wide angle lens, nor the carrying case. However it did come with a 64GB SD card all for $499.00. About what I paid for the other bundles which did include the DJI Mic 2 Transmitter, etc.

I really wanted the price with the mic included so I waited for the original Amazon order I placed. On February 27, 2025 Amazon refunded the original order explaining they were concerned about the shipment.

On March 1, 2025 (graphic illustration below shows March 3, 2025 as the entry date) I again found a great deal with Amazon, however it too was refunded on March 15, 2025 with the same explanation.

On March 19, 2025, I again ordered the same bundle from Amazon however though informing me on April 22, 2025 the order was not coming, did not automatically refund to my credit card company. The other problem, I paid off the credit card on April 18, 2025 to avoid interest charges.

When I first started discussing with Amazon what I could do about the issue

of a refund and why I was unhappy, they agreed I had been through too much and

issued a gift card on April 23, 2025 in the amount of $100.

They also indicated that since I had paid off my Amazon Signature Visa card they understood why I wanted a bank check or direct deposit issued to my business checking account. I am an Amazon Affiliate and they have my business bank information on file.

They promised the check was on the way via the USPS. This was on April 23, 2025 or so. Every day I have checked and no mail from Amazon, so this morning around 3:00 AM I started a chat to find out why no check. They indicated because it had not been processed. I was surprised by this. During the chat the Amazon associate issued a refund to my credit card company. Chase issues the Amazon Signature Visa I hold. I was upset by this because it meant, though I placed a $175 order from Amazon on April 19, 2025 that was not yet paid for, I did not want to carry $300 plus on the card for any amount of time.

That said, once the rep informed me of what she had done, I did not want it undone in case it led to more problems. I have the transcripts of the chat to show I did not ask her to refund to the credit card company.

Meanwhile on April 9, 2025 I picked up the DJI Osmo Pocket 3 Capture More Combo from Costco. Part of the $175 order from Amazon on April 14, 2025 was for the DJI Mic 2 Transmitter (Shadow Black) which was on sale for $84.00.

Okay, I did get my new camera and if you add it up you will find I paid about the same with the gift card. Why did I get the Costco deal before they informed me it was not coming? To be on the safe side since I had failed to get the Amazon orders twice.

What else am I doing about erasing the amount Chase is holding on the card? Paying some of my upcoming domain renewals with my Amazon Signature. I am also temporally changing my Verizon cell auto pay- payment method to the Amazon card. I may also take some of the real estate courses early I need to renew my license next year.

Why would they tell me the check was on the way, if it was not true? I feel since late February, I have been waiting on one thing or another and it has made me unhappy.

Did you want to ask how much the DJI carry bag and wide angle lens cost? I am a business owner and was able to purchase both items for about $34, total. Yes, this is not cry for me. It is more, why was this so hard?

Sometimes I have to get things off my chest. I will move on now.

Thursday, May 01, 2025

The end of April finally happened, and although most things I planned for were realized, I am still waiting on several large issues to be resolved.

That said, over the last 4 days I received the remaining accessories for my

DJI OSMO Pocket 3, so I finally decided to unbox everything.

I am pretty pleased with the DJI OSMO Pocket 3 and the accessories I thought I would need, including:

- DJI Osmo Pocket 3 Capture More Combo

- DJI Mic 2 Transmitter (Shadow Black)

- Magnetic Mount Stand Compatible with DJI Osmo Pocket 3

- ULANZI LM001 Magnetic Mini Light for DJI Osmo Pocket 3

- DJI Osmo Pocket 3 Carrying Bag, Compatibility: Osmo Pocket 3

- Anbee Portable Carrying Case Hard EVA Travel Box Storage Bag Compatible with DJI OSMO POCKET 3 - I like this case, however the DJI carrying bag works better in my situation.

- Wide Angle Lens 112°

Like everyone else, I also made a video of the unboxing process, however, it is rather long and I am still playing around with Davinci Resolve to edit the video. Not sure if it is that interesting, however, I am enjoying playing with the software.

Have I filmed anything with the Pocket 3? Yes, slicing up a cantaloupe,

however, I am also learning how to use the camera, and in this area I need a bit more

experience.

Not all of my purchases discussed in this post were through Amazon, however, the Amazon affiliate links are provided.

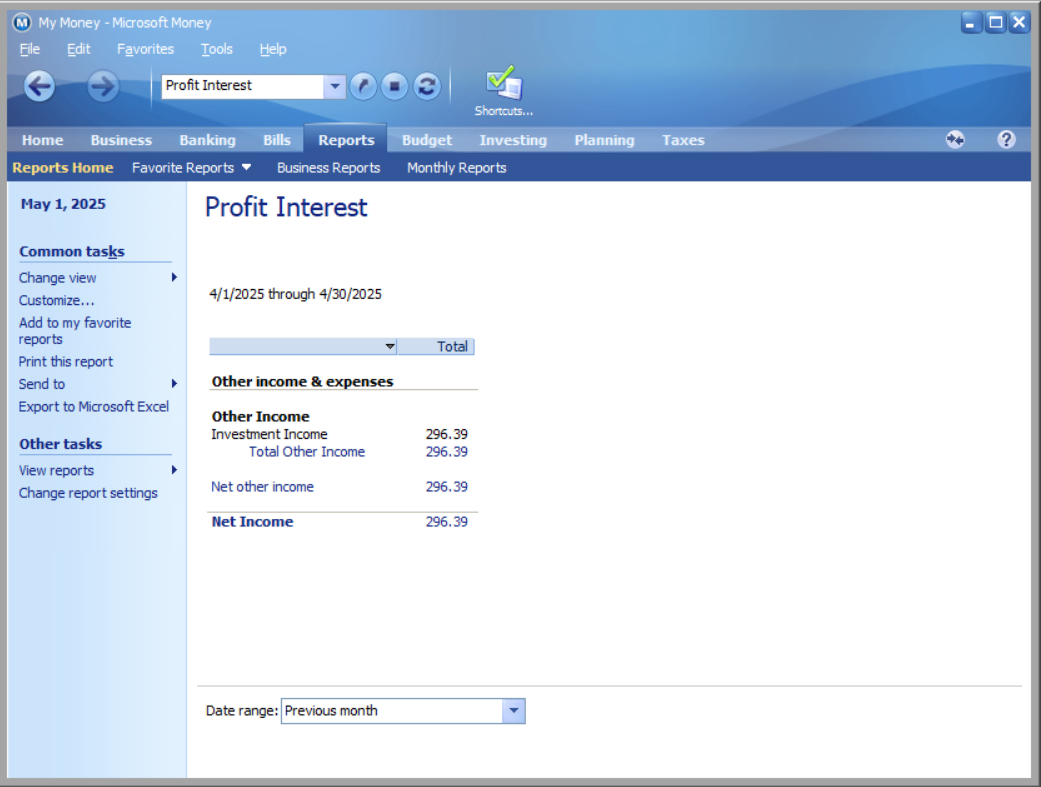

I thought 2025 was mostly going to be a no spend year, only allowing for purchases that did not exceed interest and dividend yields from my various CDs and savings accounts.

In April, I earned $296 (see below) in interest and dividend yields from my

CDs and savings accounts. I started purchasing the items listed above

in February 2025, so I get to use interest yields from February through April

in that I had only one other major expense over the same time period.

The other major expense in the same time frame, the new HP laptop. Okay, no more spending until

July. Which reminds me, one of the projects I am currently working? Retiring

my Acer Windows XP notebook.

I have rarely used the Acer notebook since the fall of 2022, however, it had too much code, data, and programs for me to leave it unattended. I have been cleaning it up for storage. This task was a little harder than I wanted, but I will feel happier putting this working, however "slow and dated" notebook into storage.

Tuesday, April 08, 2025

Sometime ago, I added the DJI OSMO Pocket 3

Creator Combo Kit, to my Just Want list.

This year I decided I would purchase the OSMO Pocket 3 and have been coming up with ways to both justify and save for the new creator combo kit.

When I decided to get

the Costco Anywhere Visa Card By Citi (discussed here), Costco offered the following DJI OSMO Pocket 3

Power Bundle for $499.

I missed out on the Costco offering, however, I am still hoping to get the camera within the next month or so.

Although, I linked my new card to my business and personal checking accounts for easy

online payments, I forgot to set the account to paperless. So

today, I received

the first monthly statement in the mail. It also included a welcome

message.

I have not received a credit card statement in the mail in awhile, in that I go paperless for most of my accounts, however, thought the one I received today was pretty nice. It also showed the zero balance on the card because I have not actually used it yet.

Thursday, March 27, 2025

Yesterday, I was out most of the morning, taking care of one errand or another. It was bright and sunny with a high of 50, however, it was very windy.

I chose an outfit I have already discussed (see this post), as a try-on outfit.

Outfit Description...

- Urban CoCo Dress

- Saks Fifth Ave Chocolate Pumps

- Brown Knit Sweater/Jacket

- Gold Button Earrings

I really wanted to offer the brown sweater/jacket in my shop, however,

unsure as to whether I can source the item from the supplier. What do you

think? Retail price point $39.95.

A lot of things going on in March 2025. Major issues included:

- Skype business line (443-393-6650) successfully transfered to my Verizon service as an additional line. Skype service to retire in May 2025.

- Jury duty excused

- Successfully opened the new CD I mention in this post.

- A number of business and non-business issues...

Hoping April will be a lot smoother.

Monday, March 24, 2025

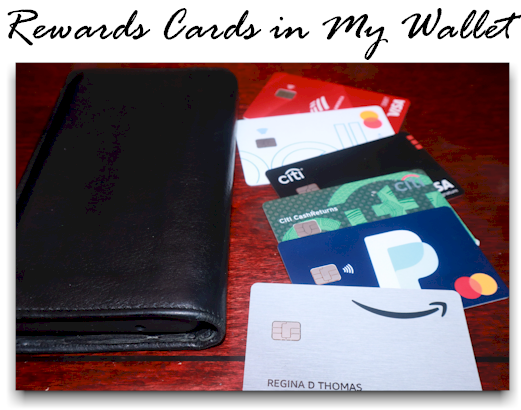

I have notable news as related to my finances for the month of March. I added new Visa and Mastercard rewards cards to my financial profile.

Why? Well lets back up for a moment and explain the rewards cards I had before March 2025. They included:

- Chase Visa (Amazon Signature Card - affiliate link) Amazon purchases 3% back, 2% gas stations, and 1% everything else.

- Citi Mastercard CashReturns 1% back any purchase

- PayPal World Mastercard 3% back using PayPal checkout (I like this card for my online shop as related to respective suppliers)

- Personal Bank Checking Debit Card if I enroll with merchants offering rewards (rewards % vary)

Where else do I spend money? Costco. Did you know- Costco Warehouses do not take Mastercard? Online, yes. So I decided to get the Costco Anywhere Visa Card By Citi. That is 2% on Costco (online & warehouse purchases) and 5% on gas. I fill up about every 5 months and never dine out.

The new Mastercard? It is the Belk Rewards Mastercard and recently it allowed me to save over $55 on gift and shoe purchases that together, totaled less than $120. The store, Belk reminds me of Macy's, Nordstroms, and other department stores I used to patronize in this area. I think Belk is more popular in southern states. I was researching online for the best deal on a pair of heels I needed and they had it.

Though, I have several other cards in my wallet, mostly debit cards and my

Amazon Store Card (unsure of the rewards), the illustration below shows only

the

rewards cards in my wallet.

The other news? On Wednesday, March 26, 2025 when the funds transfer completes, I will open a new CD for $3500 @ 4.15% for 60 mos. It is only about $10-$13 a month. My business and personal checking accounts are not interest bearing accounts and I try to make smart moves with money.

For some reason, I think CD rates are going to drop further and I want to take advantage with whatever I have available. This last statement is based only on my opinion without a lot of research into where others think rates are going.

The other thing I would like to note? I work hard to find the best interest and dividend income for my CDs and savings accounts (about $300 income per month). This to say, I do not carry balances on my credit cards. I also try not to spend more than my dividend/interest income per month. That is why I purchase gifts way in advance- if I find a good deal.

Did my credit rating take a hit because of new card applications? Wells Fargo (my business bank) shows a 26 point or so loss 796 to 770 as of 3/18/25. The others are not reporting any differences as of today, March 24, 2025.

Most know, credit applications can affect your credit rating. Mine will bounce back, I think. I think the Costco rewards card was a good move on my part because I do spend money at Costco and the online store.

Tuesday, December 10, 2024

A Certificate of Deposit (CD) I opened in August 2023 for a term of 16 months at 5.25% APY is maturing this month. When I opened the account, I only had $5500 on hand, however, felt the rate was so good I could not pass on the opportunity.

I normally use a 60 month term when I set up my CDs (I handle some financial

matters for others), however, at the time- wanted the 5.25% APY being offered

for the 16 month term. I currently have 4 other CDs, opened with a term of 60

months.

In preparation for the renewal of the maturing CD, on December 5, 2024 I transferred $3300 from

my personal checking account to the money market account I maintain with the

financial institution where I maintain my CDs.

The transfer to my money market account was due to complete, today,

December 10, 2024.

This morning after ensuring the transferred funds had posted

to the money market account, I set up the new terms for the renewal of the

maturing CD.

I have several banks and savings accounts. I currently have a little over a hundred grand in some type of savings account earning between $276-$286 a month. Most of the accounts that are not CDs are high yield savings accounts. This does not include my business & personal checking and savings accounts.

Based on my research, stock investors with the same amount ($100,000) invested in their portfolios, these days, are not earning the same returns. Theirs are less. I have been researching these numbers for the last 2 years or so and have found these numbers to be consistent.

I get a lot of communications suggesting I should invest the money in other ways. I research a lot. My numbers today show I am doing okay, in fact better than others who are investing the same amount in other ways. I will continue to track this, however, at this time see no reason to invest the money in my savings accounts in riskier areas.

I always liked a sure thing. Even when I had corporate matching funds at my disposal.

My other assets? I normally post the financial data related to only my savings accounts.

Sunday, May 05, 2024

I have always been interested in how credit and credit scores work.

Like most undergrad students I was inundated with credit card offers. When I had to worry about government contractor security clearances and my credit card charging habits I made sure I understood how it worked.

When I decided to leave Boeing to accept the position with GE, I explained to the hiring manager that part of the reason I wanted to leave Boeing was to increase my salary. I also explained that I had more credit card debt (~$2500) than I wanted, college loans (~$2500), and an auto loan/insurance.

The hiring manager asked if I had a problem with a life style polygraph. I said no and accepted the position when the offer letter arrived.

These numbers (my debt) seem small today, however, back then it bothered me. I lived at home the four years I was in college and my parents paid for a lot of things including my auto insurance through the family plan. This even though I had a part time job.

Other big expenses for me? My career wardrobe. That said, I have always spent money on fashion. The other, after leaving home- apartment rent and things for my apartment.

When I left home a year after my college graduation and about a year after accepting the position with Boeing, I really had no real experience with personal finance. About all I can say- I paid my bills.

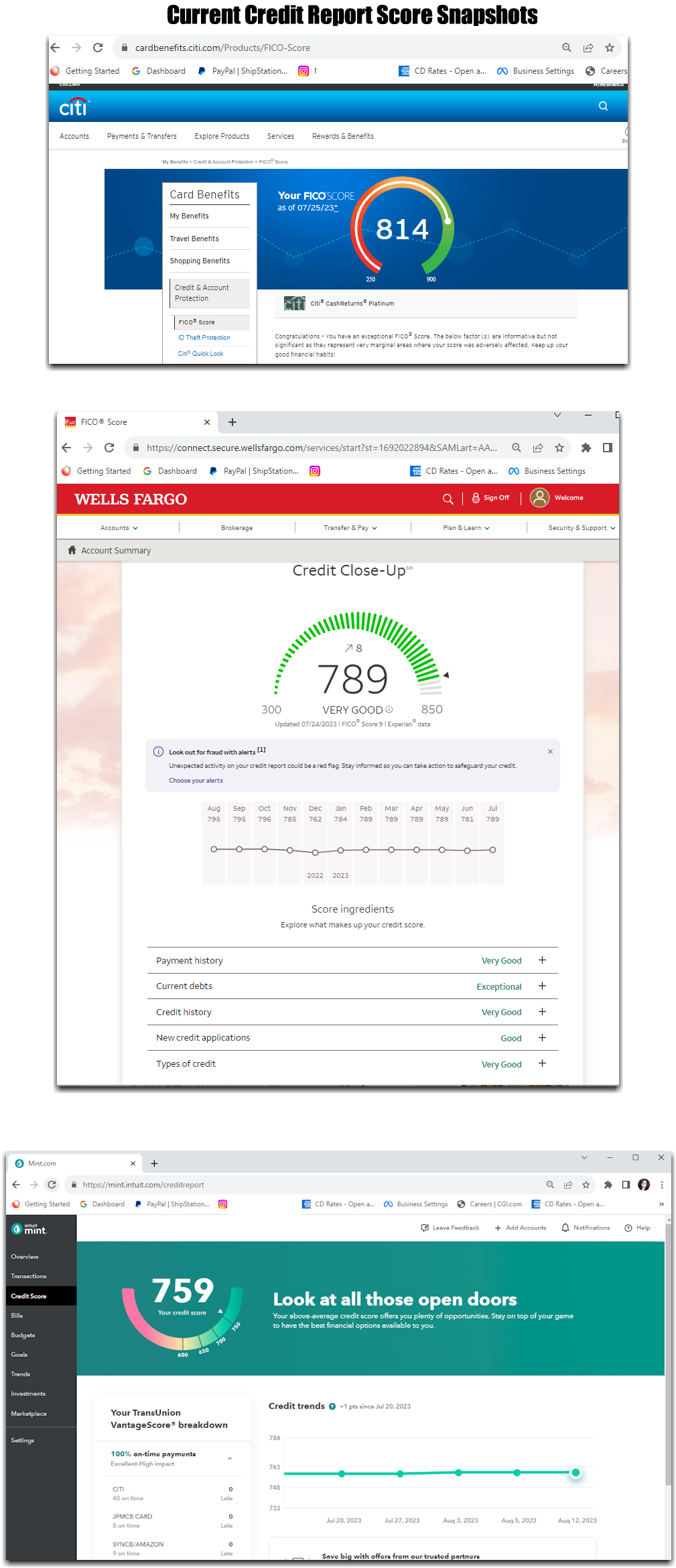

Today, I continue to track my credit scores. Last Thursday, May 2, 2024,

one of my credit cards sent an email stating my FICO score had been updated.

I did expect a change. I thought it would go down because of the new Mastercard

and it did.

I was a little surprised by how much the score changed in that my business

bank (Wells Fargo) indicated only a 9 point drop because of the new

Mastercard.

I do anticipate my credit score numbers will go back up. Last year after opening a new credit account, it took less than a year.

Was the $50 reward for opening the account worth the drop in credit scores? In my opinion, yes.

Thursday, April 18, 2024

I research quite a bit to ensure I am making sound financial decisions.

Case in point, recently, I searched the term "Average monthly yield on $85,000", because I wanted to ensure my $250 current monthly yield on that amount was comparable to other investment strategies.

I found a Youtube video- "How Much My

Dividend Portfolio Paid Me in January! ($155,000 Account)" which led

me to several other videos on the channel.

I have never been a risk taker where the stock market is concerned. My savings selections when I was employed by large corporations, mostly involved guaranteed return choices. Matching funds provided by the employers were mostly in the form of stocks and though I checked daily the corporate stock prices, did little else.

I still do not do a lot of research where stock prices are concerned (time an issue) and for some reason (probably the cost), I will not hire a financial expert in this area for assistance.

So, I have many concerns that I am not getting every dollar I can possibly get, out of my on-hand cash.

I found other content creators with similar portfolio numbers, and happy my monthly yield numbers can compete with most of these investors.

That said, my new CD (opened March 18, 2024) had its initial interest deposit

this morning.

Are you researching financial related issues? I have added links to a set of robust financial calculators to the WiredPages Business & Markets page.

Note from the illustration above, the CD calculator for my first interest payment was only off by three cents.

Monday, April 08, 2024

I have been working a number of projects, mostly business related.

- Integrated an AliExpress/Amazon plugin to my OpenCart e-commerce shop (WiredShops). The interface allows me to automatically add products from Amazon or AliExpress to my shop.

- Integrated another OpenCart plugin to enable live price updates based on options selected by the buyer for each product.

- Applying to AliExpress for access to the Drop Shipping API to allow more control of how products are added to my shop.

- Added a new category to my e-commerce shop, Digital Products.

- Preparing to offer my first digital product (MS Publisher Bank Check Template) for purchase. Ordered labels, flash drives, packaging and began the product brochure.

- Responsible for several tax return filings and happy to report I completed those tasks last week.

- Several business related filings to the State of Maryland to update records and access new services that became available at the beginning of the year.

I am very pleased most of these projects worked out well, however I have run into several problems with shipments and access to the AliExpress Drop Shipping API.

Allow me to backup. My order for custom flash drives (40), labels (210), and packaging (100) came to $63.84. Because of my past experience with business related projects, I wanted my initial investment to justify any failings I might incur.

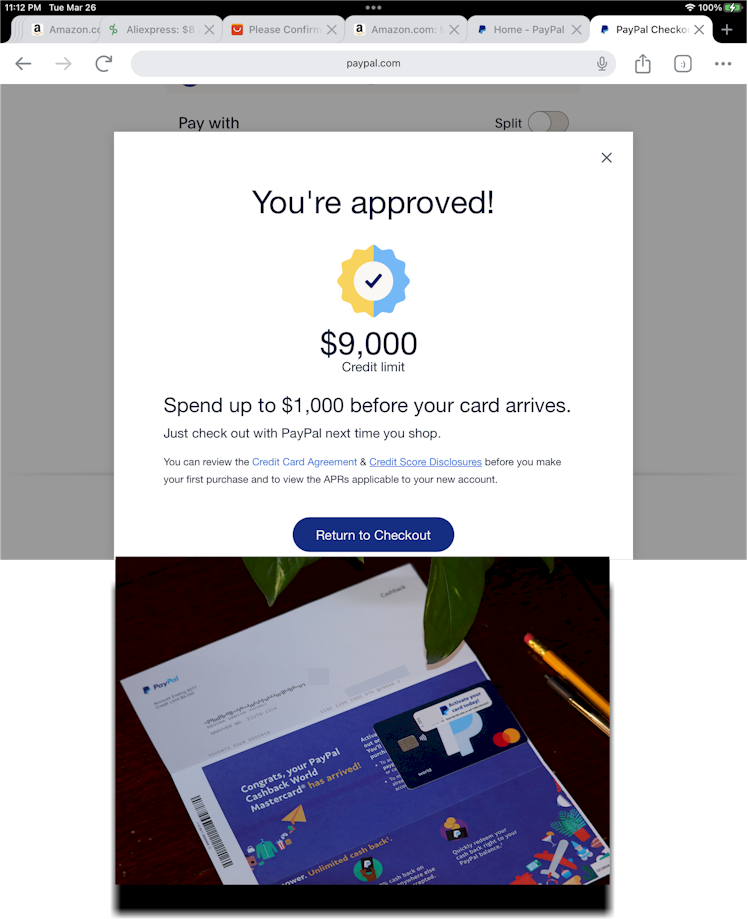

During the checkout process, PayPal offered a $50 reward if I applied for the PayPal Cashback World Mastercard. (Link provided does not include the reward. Reward I was offered- provided through the e-commerce organization I purchased from, via PayPal.)

I was approved almost immediately and thought the $13.84 investment to experiment with my digital product offering was something I could afford to risk.

What about my FICO score? I did not think it would be affected as much- because of the limit offered by the new card. I only had about $13,500 in overall credit before I applied- with no liabilities. The new card provided an additional $9,000 in credit. I also justified the new card in case I wanted to acquire more on-hand shop inventory with a great cashback offering if I checked out through PayPal.

Credit ratings are based in part- on the overall amount of credit a consumer has versus the amount owed. It is also based on the number of creditors, i.e. credit cards, mortgages, auto loans, etc.

In my case, I did not want to apply for more credit, that is until the incentives became worth my while, as was the case with the one presented in this instance.

I received the labels and packaging on Saturday, April 6, 2024, however was issued a refund for the custom logo flash drives for $49.61 because the shipper did not ship.

I researched and this was a great deal for 40 custom logo flash drives for just under $50.00. To add to my dismay, the $50 I was going to get from PayPal for opening the credit account is probably not going to be credited because of the refund. I wanted to scream.

My other annoyance, AliExpress has not yet approved my access to the Drop Shipping API. Something about, I am stuck in their legal department.

Friday, March 22, 2024

I have been researching delivery and marketing options for digital products I wish to offer, specifically the Microsoft Publisher Bank Check Template I developed several years ago.

- Bank Check Template Evolution- Related Posts

- Automation Enhancements

- Conversion to Microsoft 365 Publisher Version

- Microsoft Publisher Office 2000 - Original Template Development

In light of obvious security concerns, I have decided to ship rather than enable download of the Microsoft Publisher template for bank checks.

There are several required files that will ship with the package including the template file, setup files, and the readme (instruction) file. The files will be stored on a USB flash-drive and I am thinking of offering several pages of a security blank check stock that most banks prefer.

Note, Microsoft Publisher is not part of the package and is sold separately.

Yesterday, I put together a short video providing a first look at the usage of the template using the MS Publisher software.

I am still researching marketing, investment options (paper-stock, flash-drives), and the legal aspects of this offering, however, hope to be able to make available this digital product in the near term.

FYI: I have been using these templates for personal and business checks for years (since 2016) and have never had a problem with either of my banks (Bank of America and Wells Fargo).

Years ago, I researched correctly the requirements for development of this type of template. My research provides, sometimes this type of offering (bank check template) does not always work as expected.

Saturday, March 16, 2024

Every year, for the last 3 years I have tried to open a new CD account somewhere within the first three months of the new year with savings accrued in the prior year.

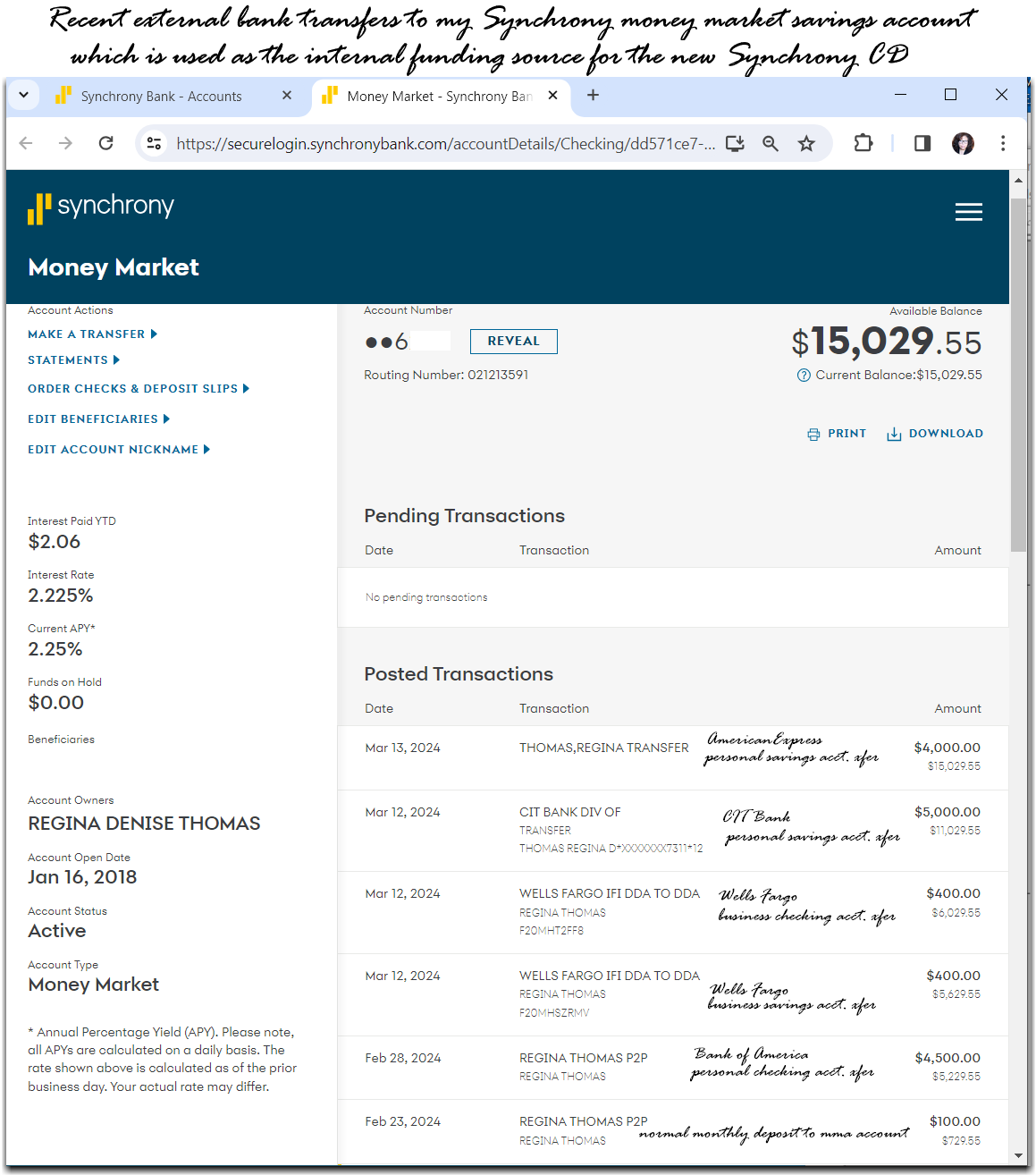

This year was no different, however I took a gamble with sourcing funds I transferred from existing high yield savings accounts I hold with American Express and CIT Bank (now a division of First Citizens Bank).

The reason it was a gamble is because the AmEX savings account has a current APY of 4.35% and the CIT SavingsConnect account an APY of 4.66%.

As shown in the first graphic for this post, the new Synchrony CD has an APY of 4% over the 5 year term of the CD. If the AmEx and CIT APYs hold for longer than I expect and also assuming CD APYs stay the same, then I would have gambled wrong and lost a little in the way of returns.

I am anticipating interest rates to go down both in terms of APY and APR and I wanted to lock in a higher rate over a longer period of time for the CD.

I have several banks used for savings and right now- Synchrony is offering the best rates on the 5 year term CD.

Why hold the savings shown- in CDs and not investment options with higher returns? I can only afford to gamble with my liquid assets in the manner I have outlined in this post.

Wednesday, February 28, 2024

When I first became eligible to apply for my Maryland Real Estate Salespersons License (Feb. 2022), I began in earnest to research the costs associated with maintaining the license as a practicing buyers or sellers agent.

The first decision I made, interview with area real estate teams to be a licensed transaction coordinator rather than a buyers and/or sellers agent. Factors involved in my decision included:

- Legal protection for my Maryland small business, QiSoftware.

- Acquire valuable hands-on experience with real estate sales in a team environment.

- Avoid some of the costs associated with being a real estate salesperson, i.e., insurance, MLS fees, membership fees, etc.

- Paycheck lower however guaranteed.

Though I interviewed with two area teams for the transaction coordinator position, they really wanted me to sign up as a full-fledged buyers/sellers agent.

In my case, I felt it pointless to continue interviewing for the licensed transaction coordinator, so instead, I decided to become a referral agent with a local brokerage.

The actual costs to maintain my active real estate license as a referral agent?

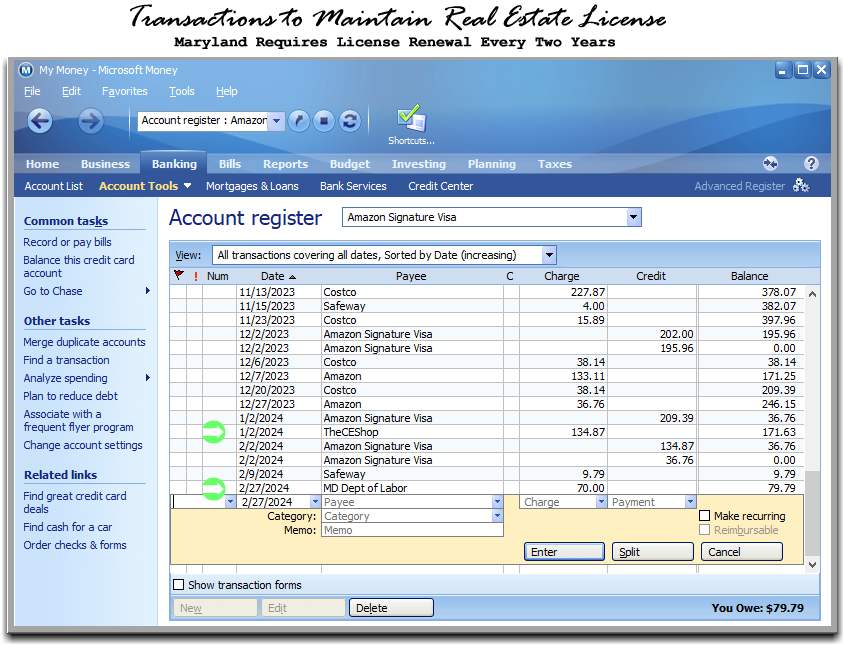

Below, a snap shot from the Microsoft Money Business software I use to track all of my financial transactions (both business and personal)- for the activity associated with my Amazon Signature Visa since last November (2023). The related transactions have a green arrow in the margin.

Though I do not need a website to renew my real estate license, I did register the domain reginathomas.studio to maintain a web presence for this service area and the related marketing efforts.

The current yearly cost to renew the domain registration is shown below.

Why pay about $200 biennially to renew the license if you are only looking to refer clients? I wanted this professional license and want to keep it. I hope some day to be in a better position to use the license as I originally intended, however right now my legal concerns outweigh my desire to actually assist clients with their needs in this area.

Home ownership is perhaps one of the most expensive purchases a couple or individual will have. Legal issues can and do come up. I have done my research. Right now, I cannot afford any legal issues- I could have avoided.

Saturday, December 02, 2023

In late October, I wanted to purchase a gift for an upcoming birthday. I had the option of using a credit card, the existing balance in my PayPal account, or opening a buyer's line of credit with my PayPal business account and getting a $20.00 discount on the purchase.

I chose the latter because of the $20.00 discount. I do have credit cards that offer rewards, however the rewards did not equal nor surpass the $20.00 savings by opening the new line of credit.

I made the purchase on October 25, 2023 and paid the entire balance off on October 29, 2023 when the bill came due (had until November 22, 2023 to make the first payment).

I was also happy to add another creditor to my credit profile, in that credit reporting agencies indicate part of the reason my credit scores are not perfect- is because I do not have installment loans nor a mortgage.

I was a little concerned about the hits my credit scores would take with a new credit inquiry. This because, late last year when I opened two new credit cards, I noticed that though my scores initially went down, were almost back to where I started by late summer of this year.

The following illustration shows my current credit scores from TransUnion, Equifax, and Experian. If you zoom on the graphic- you will see the recent score history from each organization.

Keep in mind, I never carry a balance on my credit cards, nor will I with this new line of credit from PayPal Buyer's Credit.

Was the new line of credit worth the slight dip in my scores? Yes. I received a $20 credit on the purchase and a new creditor who will show every month that I am never late.

Do you want to ask, "What are you going to do, now that Mint is closing its doors?" I have not decided. That said, I am going to miss Mint.

Friday, October 13, 2023

Because of a banking irregularity when I opened my first business checking

account (Oct. 2004), I use the many resources banks and services like Intuit offer to

ensure these institutions see my banking activity in real time- across the

board.

Because of a banking irregularity when I opened my first business checking

account (Oct. 2004), I use the many resources banks and services like Intuit offer to

ensure these institutions see my banking activity in real time- across the

board.

Some of the online banking resources I use, include:

- Bank of America (personal checking & savings accounts) allows aggregators to access all of my linked accounts providing current account balances and transaction activity for each account.

- Intuit's Mint also uses aggregators to access each linked account which provides the linked account balances and transactions.

- In total, I have 5 different banks for checking and savings accounts. Only one is used for business banking. All of these banks are linked so that I can easily transfer funds to open a new CD or an existing account.

- I also have credit cards with Chase, Amazon (store card, Synchrony), and CitiBank and link my personal and business checking accounts to the banks that provide the cards- for easy online payments.

I love online banking, and have convinced those who I help to manage their assets, that it is the way to go. That said, my influence insofar as others and their finances- does not extend to services like Intuit's Mint. In general they seem to feel their financial data is not Mint's business.

In my case, I have to worry about the business side of finance as well as my personal finance, however because I am a sole proprietor prefer to maintain tax related finances under the same category (I do not use a business EIN).

That said, I do maintain separate checking and savings (Wells Fargo) accounts for my business finances. All of my other bank accounts are with other banks and are all personal accounts.

I am a good record keeper, in that I like all accounts accurate at all times. I spend about 20 minutes daily checking and updating, online accounts, Excel spreadsheets and two Microsoft Money files. In total, I have 17 bank accounts and manage well over thirty.

So how do I keep up with financial accounting activities? Online banking, Mint, Excel and two versions of an old software package called Microsoft Money. If even a penny is missing, I have to reconcile the books.

The first illustration below, provides payments made to several of

my interest bearing accounts for September 2023 as reported by Microsoft Money,

Bank of America, and Mint. In total, I had $212.44

deposited as interest payments to various accounts. Each reporting instrument

agrees with this total.

The second illustration, shows the 'to date' interest payments made to my accounts for the month of October 2023. I am expecting an additional $42 (or so) in interest payments for the month of October.

I like knowing my financial well being is known by all. I do not mind the transparency. I never really understood what happened with my first business checking account, however I did contact the legal authorities on the issue.

Saturday, October 07, 2023

Lately, it seems I have been working one project or another. Quite a few of the issues involved updates to existing software or applications, like the recent changes to programs to handle my Amazon affiliate links.

In addition, with all of the research related to content creators I have also noticed some interesting ideas I thought I would look into.

I like business, so I tend to checkout what other small businesses are doing in as far as income streams or side hustles.

One area I thought interesting, Youtubers discussing their in-depth financial situations and offering their Microsoft Excel templates via Etsy shops to help maintain budgets. Some of these Youtubers appear to be doing very well in this area.

Years ago, when I wanted to cut more operating costs, I decided I would no longer order bank checks which I seldom used. Instead, I created Microsoft Publisher bank check templates for both my business and personal checking accounts. I discuss this in this July 2016 blog post.

After I began using Microsoft 365 I converted the templates to the later Publisher version (discussed here), so I now have templates in Microsoft Publisher 2000 & 365.

Earlier today, I created a more generic Publisher bank check template and automated the update of the check numbers. The versions I use, require manual update of the check numbers, however as I have already indicated, I seldom write checks.

I will discuss this project later in more detail- after I finish with the video.

Yesterday, after lunch, I worked on perfecting my banana split.

Also watching videos from these creators...

- Caitlin Blue 10K

- Ellen Miller 4.96K

- Lou 31.8K

- Natalie Bennett 327K

- Overthinker Apparel 200K

I have more projects and videos coming up....

Tuesday, August 29, 2023

I have been working several projects, including:

- Integration of a Google-certified Consent Management Platform (CMP) to all of my sites and subdomains, i.e., WiredPages, It's Personal (this blog), etc.

- MS Access Database to maintain my Amazon affiliate links & stores

- Researching and setting up a new Certificate of Deposit (CD).

The first project listed above- was actually completed earlier today so let's start there.

For several months, the home screen of my Google Adsense account has shown

the following notice.

Several years ago, I integrated the CloudFlare interface to all areas of my sites to handle the General Data Protection Regulation (GDPR) law that came into effect in May 2018.

CloudFlare is not a Google-certified Consent Management Platform

(CMP), the reason the notice began to appear several months ago on the

homepage of my Adsense account.

So from the above list of certified CMPs, I chose Quantcast because I have been using the service for years on all areas of my sites to track traffic and other statistics, and thought it was the natural choice for my needs.

Quantcast allowed the option to show the popup message and dialog options to only EEA and UK visitors to my sites, so those in other areas including the U.S., will not see the message nor options.

The second project listed above, MS Access database to handle affiliate links was completed on Sunday. I am pretty pleased with how this project turned out, and happy I have a more efficient way to maintain and provide my Amazon affiliate data. See the upper sidebar of this blog (under Amazon Stores) or the WiredPages Libraries page for illustration of what the new database provides.

The last project, setup a new savings CD- was actually completed on August 22, 2023 when I noticed the APY on a 16 month term CD jumped from 5.10% to 5.25%. I had transferred the funds from two of my checking accounts a few days earlier and hoped the APY would increase. It did, and I set it up.

Monday, August 14, 2023

Over the past month, I have noticed shorter term CD APYs are on the rise. Over the last two or three years, 5 year CD APYs were higher, so I setup several CDs to take advantage of the rates banks were offering.

This week I will setup a new 12 month CD with an APY of 5.10%, and hope the accounts I am transferring the funds from will not be needed for an emergency in the next month or so.

Since I am discussing financial issues, I do have some good news- my FICO scores are on the rise again. After I applied for and obtained two new credit cards last year my credit scores went down. Reference this post or the finance category of this blog where I provide ongoing details about my credit scores.

On my journey to monetize my Youtube Channel, there was also more good news, I now only need 500 subscribers rather than 1000. (This is rather a giggle at this point. Someone indicated my subscribe button does not work, however I tend to be rather sporadic with video uploads.)

I have also started planning and making healthier meal choices.

I am particularly happy about a green beans recipe (I use garlic powder rather than garlic cloves) I found, which I add to sauteed chicken breast.