Monday, March 24, 2025

I have notable news as related to my finances for the month of March. I added new Visa and Mastercard rewards cards to my financial profile.

Why? Well lets back up for a moment and explain the rewards cards I had before March 2025. They included:

- Chase Visa (Amazon Signature Card - affiliate link) Amazon purchases 3% back, 2% gas stations, and 1% everything else.

- Citi Mastercard CashReturns 1% back any purchase

- PayPal World Mastercard 3% back using PayPal checkout (I like this card for my online shop as related to respective suppliers)

- Personal Bank Checking Debit Card if I enroll with merchants offering rewards (rewards % vary)

Where else do I spend money? Costco. Did you know- Costco Warehouses do not take Mastercard? Online, yes. So I decided to get the Costco Anywhere Visa Card By Citi. That is 2% on Costco (online & warehouse purchases) and 5% on gas. I fill up about every 5 months and never dine out.

The new Mastercard? It is the Belk Rewards Mastercard and recently it allowed me to save over $55 on gift and shoe purchases that together, totaled less than $120. The store, Belk reminds me of Macy's, Nordstroms, and other department stores I used to patronize in this area. I think Belk is more popular in southern states. I was researching online for the best deal on a pair of heels I needed and they had it.

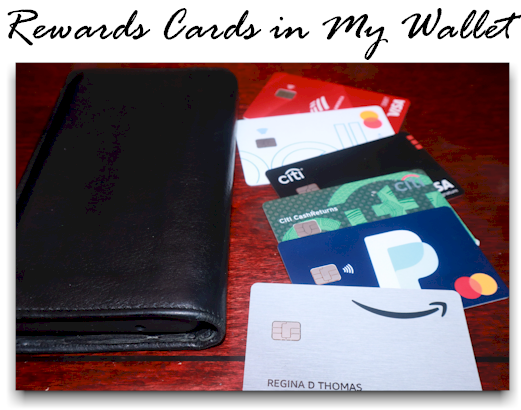

Though, I have several other cards in my wallet, mostly debit cards and my

Amazon Store Card (unsure of the rewards), the illustration below shows only

the

rewards cards in my wallet.

The other news? On Wednesday, March 26, 2025 when the funds transfer completes, I will open a new CD for $3500 @ 4.15% for 60 mos. It is only about $10-$13 a month. My business and personal checking accounts are not interest bearing accounts and I try to make smart moves with money.

For some reason, I think CD rates are going to drop further and I want to take advantage with whatever I have available. This last statement is based only on my opinion without a lot of research into where others think rates are going.

The other thing I would like to note? I work hard to find the best interest and dividend income for my CDs and savings accounts (about $300 income per month). This to say, I do not carry balances on my credit cards. I also try not to spend more than my dividend/interest income per month. That is why I purchase gifts way in advance- if I find a good deal.

Did my credit rating take a hit because of new card applications? Wells Fargo (my business bank) shows a 26 point or so loss 796 to 770 as of 3/18/25. The others are not reporting any differences as of today, March 24, 2025.

Most know, credit applications can affect your credit rating. Mine will bounce back, I think. I think the Costco rewards card was a good move on my part because I do spend money at Costco and the online store.