Saturday, March 16, 2024

Every year, for the last 3 years I have tried to open a new CD account somewhere within the first three months of the new year with savings accrued in the prior year.

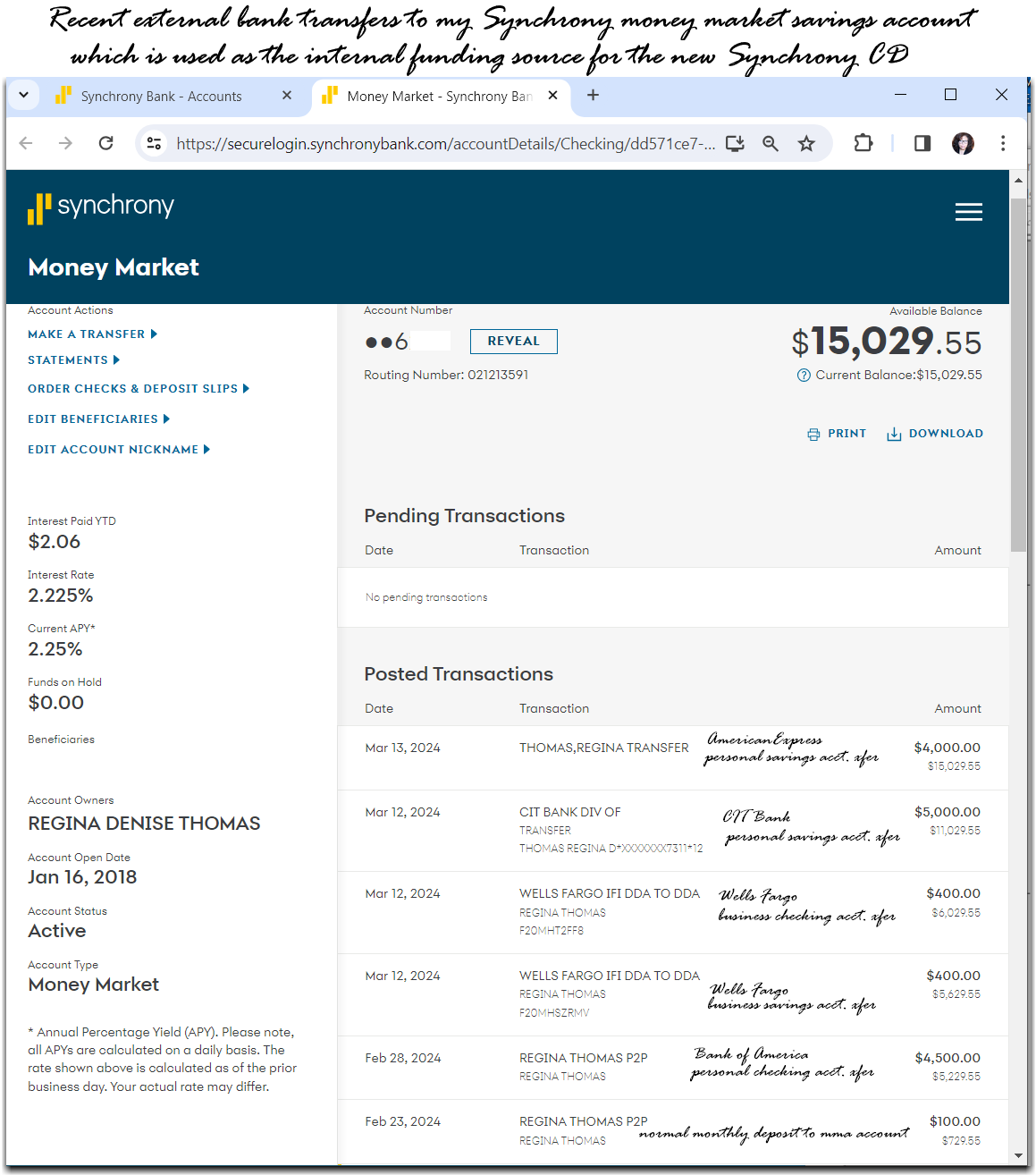

This year was no different, however I took a gamble with sourcing funds I transferred from existing high yield savings accounts I hold with American Express and CIT Bank (now a division of First Citizens Bank).

The reason it was a gamble is because the AmEX savings account has a current APY of 4.35% and the CIT SavingsConnect account an APY of 4.66%.

As shown in the first graphic for this post, the new Synchrony CD has an APY of 4% over the 5 year term of the CD. If the AmEx and CIT APYs hold for longer than I expect and also assuming CD APYs stay the same, then I would have gambled wrong and lost a little in the way of returns.

I am anticipating interest rates to go down both in terms of APY and APR and I wanted to lock in a higher rate over a longer period of time for the CD.

I have several banks used for savings and right now- Synchrony is offering the best rates on the 5 year term CD.

Why hold the savings shown- in CDs and not investment options with higher returns? I can only afford to gamble with my liquid assets in the manner I have outlined in this post.