Friday, March 09, 2018

Every now and then, I publish details about my business related expenses.

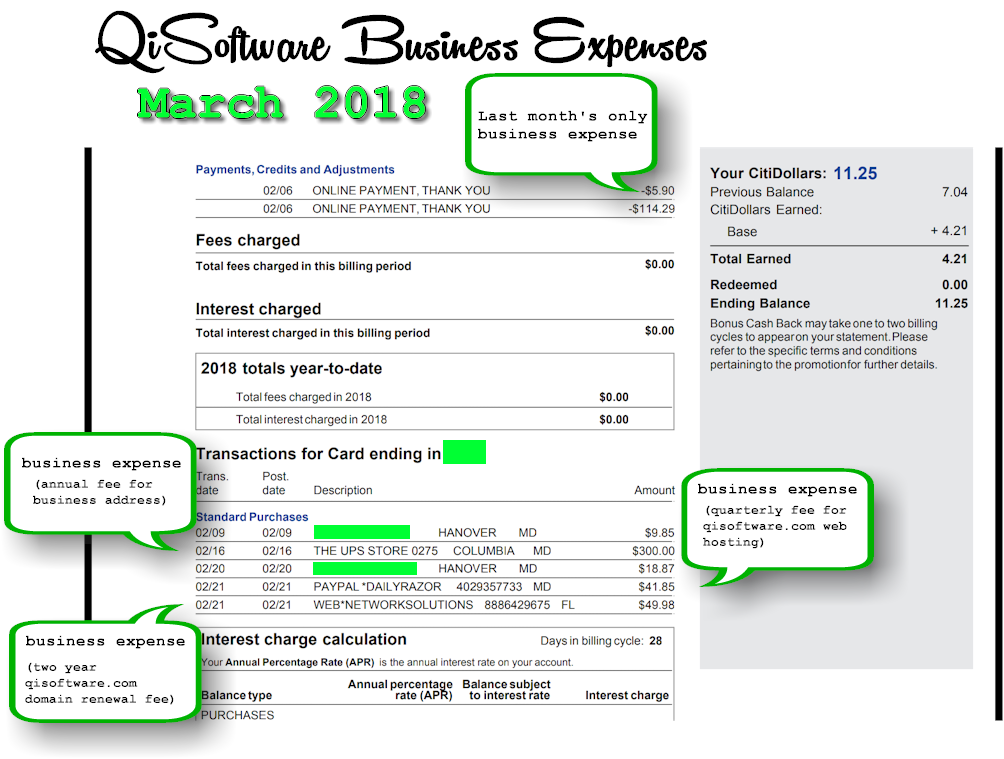

March is normally more expensive as related to business than other months because my annual business address fee is due in March.

That said, because I opted to pay the qisoftware.com domain renewal fee early (actually due June 2018), my business related expenses for this March were made more so.

Note my business is registered with the State of Maryland as a Trade Name entity, i.e., Sole Proprietorship, so though I use a personal credit card for some of my business related expenses, I actually separate the expenses as either business or personal and pay the card issuer with either my business or personal bank account depending on the expense.

I track business and personal expenses separately using Microsoft Money for Business & Personal use [Quicken for Business & Personal Use another great choice], however at this time- I do not deduct business expenses.

The type of business I own allows for the use of my social security as the tax identification number associated with the business. Perhaps once a year, I review the request form for a Federal Employer Identification Number [EIN], however to date, can think of no reason I would want to do this.

I simply like the one tax identification number associated with both my personal and business affairs and because I do not outsource nor hire contractors, this works for me.

Products discussed in this post (latest version of Quicken):