Wednesday, December 28, 2022

I thought it was a nice holiday. Relatives stopped by on Christmas Day and Monday. I spent Christmas morning baking, prepping a roast, and putting together the side table shown in the following photos (click the photos for details about the table).

Tuesday, I planned to be at the bank bright and early however, my bank deposit receipt is timestamped 11:31AM. I also wanted to get somethings heading into the weekend. I am making glazed pork chops and dressing for the first.

After leaving the bank I went by Costco. The velvet jeans I discussed in the last post were no longer on sale, however they had the deep burgundy in my size so I figured I could splurge on another pair at full price.

I felt the sweater and dark brown booties by Anne Klein, items I already owned- would match the burgundy jeans. The sweater is a good contrast however another pair of caramel suede Anne Klein's, here again- I already owned, was a better match.

Last night, after all my chores I had to set my hair. I meant to touch up my roots by the first, however feel I am going to miss the deadline.

I took some photos then started flipping channels. I noticed "Three Days of the Condor" was being aired on one of the cable channels. Are there movies you just stop and watch? This is one of mine.

I have a lot of plans for the new year, however I think I am going to close out the year doing mostly nothing. Oddly enough, I am looking forward to the next few days.

Saturday, December 24, 2022

Lately, most of my purchases are for business, necessities, or gifts. That said, in September (2022), I did purchase four pairs of shoes that can only be described as a splurge.

This post is about purchases since early November (2022), that are a mix of either business, necessity, or splurge. As in the case with the purchase of the shoes in September, I consider the price to own, the most important factor in acquiring the new items.

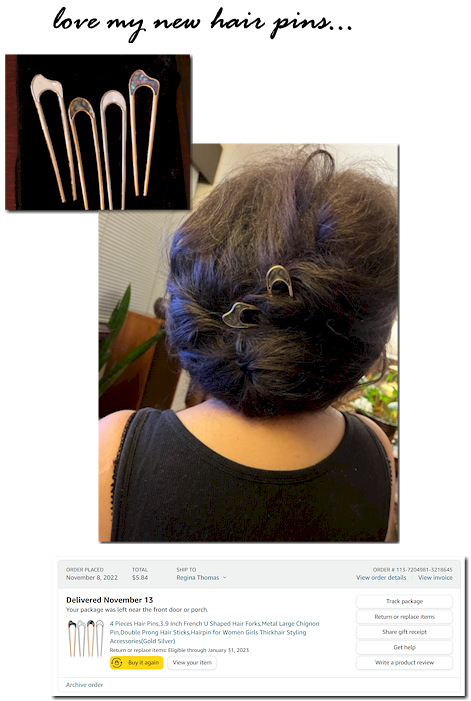

Let's start with my new hair pins. The hair pins were a necessity. As noted in the order information provided below, I paid $5.84 for the four hair pins that I simply love. (Mother sent the photo via her phone).

Why is this a great price? My ecommerce shop- WiredShops provides access to wholesale prices for a wide range of goods. I was able to find the wholesale price I would pay to stock the hair pins and was quite frankly a little surprised. Depending on when the Amazon seller I purchased from acquired the inventory, he may have taken a loss. I am not sure.

My new thermal label printer is categorized as a business expense. I have been researching thermal label printers since my online shop went live (October 2021). Though I really could not justify acquiring the new printer (not really shipping enough product), the price to acquire because of Amazon gift cards and the right printer went on sale- was simply to attractive to pass on.

The printer driver that came with the printer on a flash drive supports most of my desktops, mini pcs, and tablets, including an older Windows XP Desktop and my iPad Mini. For my needs, this was a good choice.

The last purchase, a pair of black velvet jeans by a brand "Well Worn" that I had previously not heard of, was a splurge.

Friday, Dec. 16, 2022, I was in Costco, picking up things like paper towels and the normal staples purchased from this club warehouse when I happened on the jeans. There were several color options, but of course I had to have black. When I arrived home I checked online and found I paid between $30-$8 less than most places selling the same item.

Today, is December 24, 2022 and I am happy I did not have to go anywhere. It has been cold and wet, and yesterday a relative called to say they lost power.

I think I am ready for tomorrow. Hope you are enjoying your holidays.

Thursday, December 15, 2022

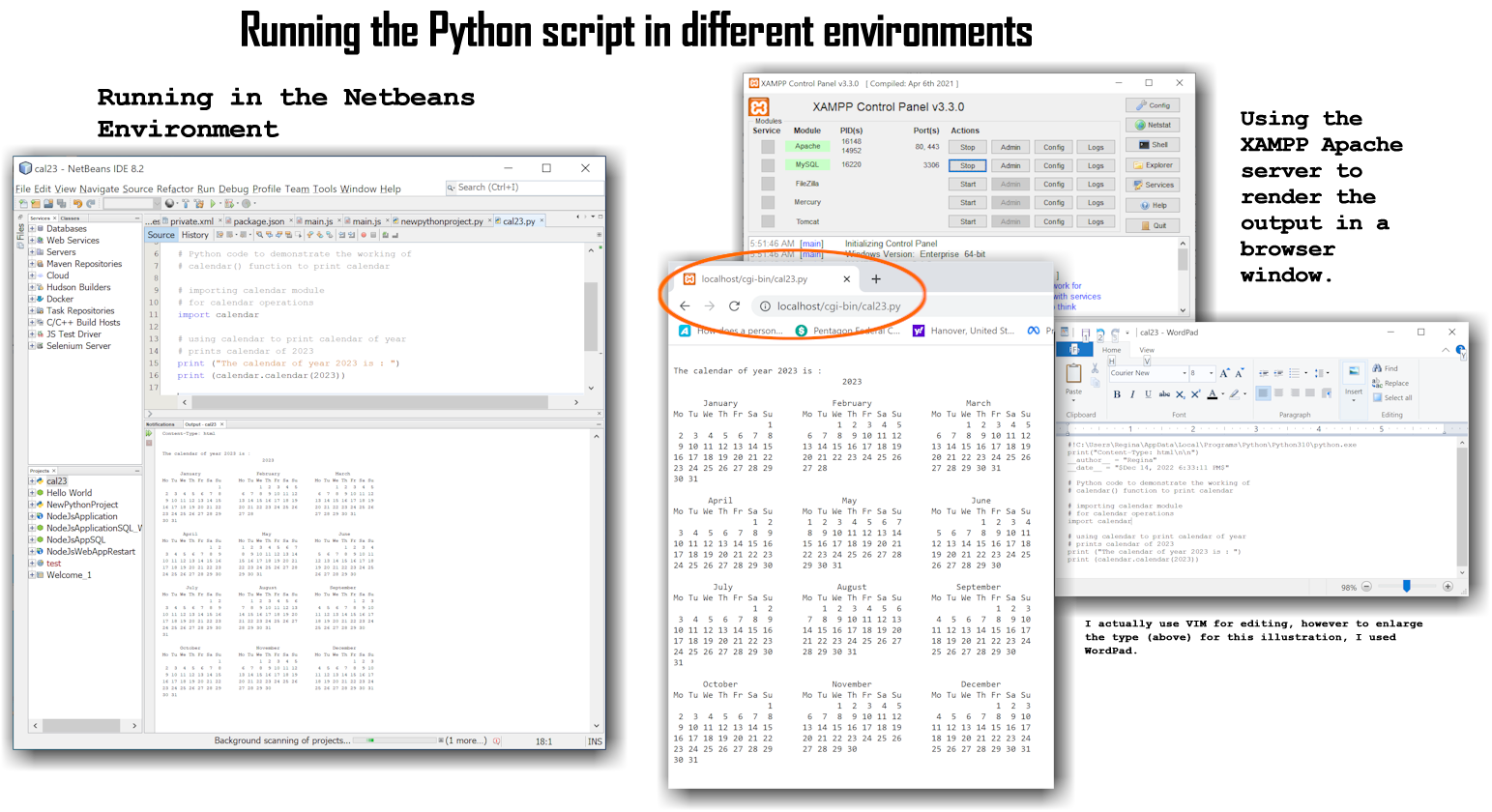

Yesterday, I spent the day setting up Python on my experimental development mini PC and researching what would be required to setup my online hosting services to run cgi-bin Python files.

Normally, when I run php, c, or java files from the Netbeans environment, I can launch an external browser window to show the results.

The Netbeans plugin I installed for Python does not allow that option so I used the existing XAMPP Apache server to allow for manual requests of the Python script files. Php and MySQL requests also require the XAMPP Apache server in my developmental environments, however Netbeans can directly launch the browser using XAMPP in the background for these types of programs.

I installed Python39 in August 2021 on the same mini PC, however neglected to set the path correctly, so reinstalled a later version yesterday to enable the Apache XAMPP server access. Netbeans had no problem finding the older Python installation even though it was not part of the path environment.

I used to routinely update Windows autoexec.bat and config.sys system files and now cringe at the thought of having to manually do this with newer versions of Windows operating systems. The problem? More, where did I put those.

What about Python running on my online hosts (qisoftware.com/hosting-q.com)? I am continuing research into running cgi-bin files from my Apache Tomcat online hosting packages. That said, Python is an open scripting language, so I have no plans to use this resource for my own needs however can provide support for clients who would prefer programs written in that language.

Below is a photo of the mini PC (also the real estate course mini PC) I use to setup new experimental development environments. I do not setup these experimental development tools on the mini PC I use for production purposes (cannot afford to corrupt that environment), however the mini PC I use for the non-production development is now also the host for this blog. Long story short, I am thinking of getting a new mini PC. What do you think of the one shown below?

Still in the research phase of this purchase, however I have to say, I love the footprint (size) on the PC I have shown above.

Monday, December 12, 2022

As expected, Sunday (December 11, 2022), my TransUnion credit score was updated and increased slightly according to the report offered through Mint.

Reference this discussion about why I was a little annoyed about the credit reporting. I continue to feel the TransUnion score is a little too low.

For the past week or so I have been shopping for a new Certificate of Deposit (CD). Since I already have accounts with financial institutions offering some of the best rates, my research only involves monitoring rates being offered by two of my banks, American Express and Synchrony.

The Federal Reserve will be issuing new data on rates, I think- December 14, 2022, so I am waiting to see if the reports hold concerning a 50 basis point increase. This increase could have an effect on new rates my banks are willing to offer.

Recently, I have been doing a lot of research into financial planning and routinely monitor investable assets that can be moved into high yield savings accounts and/or CDs. I use two versions of Microsoft Money (business and personal versions) to track these assets.

Yesterday, I decided I needed a summary spreadsheet, so I would not have to log into the separate Money files to see the data. I developed an Excel spreadsheet for this data summary.

This weekend, I planned any number of projects, however because I wanted to watch the full first season of "Injustice", a series out of the UK, I did not get to everything I wanted to do.

That said, playing with this Excel Spreadsheet and some of the underlying formulas was kind of fun.

Saturday, I also made a western omelette for breakfast.

Friday, December 09, 2022

Yesterday, I went by two supermarkets for staples and Costco for gas. I spent a total of $145 with about $35 of that for the gas. Yesterday, gas was $2.95 per gallon at Costco.

Monday, December 05, 2022

Maybe some of you are aware that I am an admin for my high school's alumni group on Facebook. This year, the varsity teams for girls volleyball and boys football have been involved in regional and state championship games. Over the last several weeks, it has been fun watching and reading the reactions from some of the 6K members of the alumni group to these events.

Though Arundel did not win either of these finals, they were pretty impressive throughout the season and many of the alumni members let them know.

What else have I been up to? Cooking, baking, shopping, working, being annoyed (last post), researching tech layoffs and financial news, and taking photos.

On Cyber Monday, I was at Costco bright and early to pickup a gift I wanted. There was a sizeable saving if I purchased the gift by November 28, 2022. Once I knew I had the gift (out of stock concern), I was able to order other gifts which arrived by Saturday, December 3, 2022. I am mostly finished with my holiday shopping, and Mint is happy to let me know I went over budget.

This year, I had a budget of $400 and spent about $425.

That said, if I had paid full price for everything, I would have spent about $650, so I had an overall savings of about $225.00.

Do you think that is a low budget for holiday gifts? These days, I tend to purchase things that are needed on the spot. Gifts are received throughout the year.

Do you want to know if I am losing weight with all of the holiday treats shown in the photos for this post? Yes, believe it or not. I have been getting exercise through chores and eating in moderation.

Hope your holiday plans are going well.

Sunday, December 04, 2022

My observations with my personal credit reports began shortly after I moved away from home after graduating from college. I think the one thing most undergrad students know, on campus there is a concerted effort to have students apply for credit, and I did.

My parents gave me a gas credit card when I was in high school, so until that point, that was all the understanding I had to have about credit.

While in college, I lived at home, however had a part time job and attended as a full time student. My credit profile began while in college and quite frankly looked good. Creditors loved me.

Early, in my four year journey for my undergrad degree, I think my parents wanted to ensure I was serious about college. So one semester they requested I take out an education loan (only for that semester's fees) with my credit union (Tower Federal Credit Union). I also took out a new car loan in my sophomore year.

My parents paid all of my living expenses while in college, except the payments on those two loans. Including my auto insurance. During my high school and college years, you would not believe how many times my car was hit, while parked in front of our house.

The year I started my first professional job, I purchased a little two seater with a higher insurance premium. This was in September 1981. In December 1981, my relatively new car was hit while parked in front of my parents house. My auto insurance was high, however always paid through the family policy. These accidents, though no fault of mine, were paid through the family policy however my cars were always registered in my name.

When I moved away from home (June 1982), a year after graduating and acceptance of my first professional position (Boeing), I began to look into credit. I cannot now remember why, however I still remember the credit reports I ordered from the credit reporting agency on occasion.

When I left home, I had more expenses including my own auto insurance policy. Maybe I should have had more expenses before I left home. I did have a low interest college loan, several credit cards, and my new sports car loan, but that was all by the time I moved in 1982. Other loans had been paid off while in college.

The other thing I understood about my credit rating- because I was a defense contractor with a top secret security clearance, I wanted it to remain in the good range.

All of this to explain- why I began looking at my credit ratings early in my professional career. When I wanted to purchase a new home, I set about ensuring my credit rating would be inline with what a mortgage company would accept. And they did.

If I had problems early, it was because I was spoiled as related to credit and had to learn somethings quickly, after I left home.

As a matter of fact, 3 and a half years after first signing with Boeing, I decided, I wanted a career change and looked at different positions. General Electric, explained they would like to hire me, however they would need a lifestyle polygraph. I explained to the hiring manager that I had no problem with the lifestyle poly, however one of the reasons I wanted a career change was I wanted more in the way of salary and also explaining the minor issues I had with debt. He said, there would be no problem with the debt issue and I said there would be no problem with the lifestyle issue. I accepted the position with General Electric.

I left the position with General Electric because it was not what I expected it to be. Boeing had perks that GE did not offer, e.g., my own office, phone, business cards, etc and GE was different. I wanted a more formal setting like I had with Boeing and Rockwell International offered the perks I was used to. I accepted the Rockwell International offer 6 months later. I was with Rockwell for 10 years.

So why am I discussing this? Last night I received an email from the bank that extends credit on my Mastercard (Citi Bank), explaining my FICO score had been updated.

I was a little concerned given my recent observations with the TransUnion reports provided via my Mint account. Mint updates my credit score every 7 days or whenever they receive updates to my credit standing, e.g., new cards added, new inquiries, etc. Applying for credit does impact FICO scores. In 1983 or so, when I first started researching my credit reports, FICO scores were not used. Back then I wanted an "R1" with a lot of months with the same rating- for each credit item on the report.

Today the FICO score offered by my Citibank Mastercard uses Equifax and their latest rating is shown below.

Last night, I was relieved when I took the screenshot shown above. This morning, I checked Mint (TransUnion), and wanted to be annoyed with the screenshot shown below.

I went over the TransUnion report trying to understand why there might be so much difference between the two scores. I have written notes on the screenshots I am using in the illustration below:

I am not sure why the Mint credit report does not show the Citi Mastercard payments on 11/04/22 and this might be a factor as to why the rating is lower. That said, Mint's aggregation process used to stay up to date with all of my financial accounts and related activity- does reflect the payments to Citibank on November 4, 2022.

I am hoping all of this updates early next year, reflecting more positive scores across the board. Even if it does not, I will have learned more about how modern credit ratings are derived. See this post- FICO Realities and Recent FICO Activity for more about my recent credit activity.

I thought of a title for this post, after I had written it.